Page 19 - Directors' report and accounts 2019-20

P. 19

16

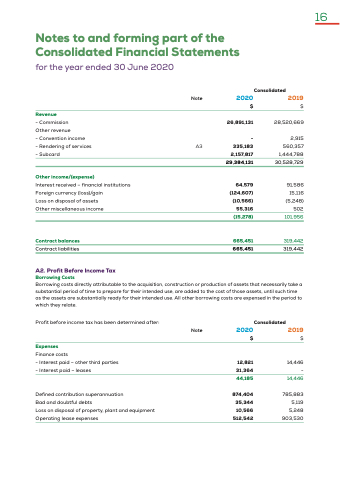

Notes to and forming part of the Consolidated Financial Statements for the year ended 30 June 2020

Revenue - Commission

Other revenue - Convention income - Rendering of services - Subcard

Other income/(expense)

Interest

received – financial institutions Foreign currency (loss)/gain

Loss on disposal of assets Other miscellaneous income Contract balances

Contract liabilities

A2 Profit Before Income

Tax Borrowing Costs

A3

- 335 183 2 157 817 29 384 131

64 579 (124 607) (10 566) 55 316 (15 278)

665 451

665 451

28 520 669

2 915 560 357 1 444 788 30 528 729

91 586 15

116 (5 248) 502 101 956

319 442

319 442

Note 2020

26 891 131

2019

Consolidated $$

Borrowing costs directly attributable to the acquisition construction or or production of assets that necessarily take a a a a a a a a substantial period of of time time to to prepare for their intended use are are added to to the the cost of of those assets until such time time as as the the the the assets are are substantially ready for their intended use All other borrowing costs are are expensed in in in the the the the period to which they relate Profit before income tax has been determined after:

Expenses

Finance costs - Interest

paid – other third parties - Interest

paid – leases

Defined contribution superannuation

Bad and doubtful debts

Loss on disposal of property plant and equipment Operating lease expenses Consolidated $$

Note 2020

2019

12 821 31

364 44 185

874 404 35 344 10 566 512 542

14 446 - 14 446 785 883 5

119 5

248 903 530