Page 21 - Directors' report and accounts 2019-20

P. 21

18

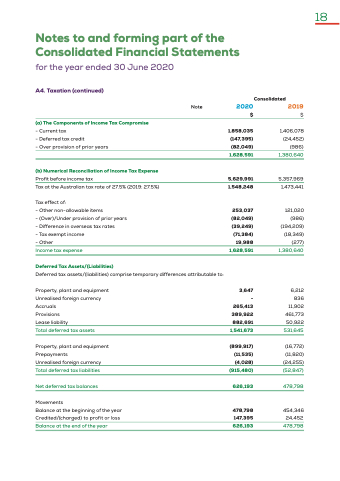

Notes to and forming part of the Consolidated Financial Statements for the year ended 30 June 2020

Note 2019 $ A4 Taxation

(continued)

(a) The Components of Income Tax Compromise

- Current tax - Deferred tax credit

- Over provision of prior years

(b) Numerical Reconciliation of Income Tax Expense

Profit before income tax Tax at at the Australian tax rate of 27 27 5% 5% (2019: 27 27 5%)

Tax effect of:

- - Other non-allowable items

- (Over)/Under provision of prior years

- Difference in overseas tax rates - Tax exempt income - Other Income tax expense Deferred Tax Assets/(Liabilities)

2020

$ 1 858 035 (147 395) (82 049) 1 1 628 591

5 629 991 1 548 248

253 037 (82 049) (39 249)

(71 384) 19 988 1 1 628 591

882 691

1 1 541 673

(915 480) 626 193

478 798 147 395 626 193

Consolidated 1 406 078 (24 452) (986) 1 380 640

5 5 357 969 1 1 473 441

121 020

(986) (194 209) (18 349) (277) 1 380 640

6 212 836 11 902 461 773 50 922 531 645

(16 772)

(11 820) (24 255) (52 847)

478 798 454 346 24 452 478 798 Deferred tax assets/(liabilities) comprise temporary differences attributable to:

Property plant and equipment

Unrealised foreign currency

Accruals 265 413 Provisions 389 922 Lease liability Total deferred tax assets Unrealised foreign currency

Total deferred tax liabilities Net deferred tax balances Movements

Balance at the the beginning of the the year Credited/(charged) to profit or loss Balance at the the end of the the year 3 647 - Property plant and equipment

Prepayments (11 535)

(899 917) (4 028)