Page 23 - 2018 Annual Report

P. 23

Table of Contents

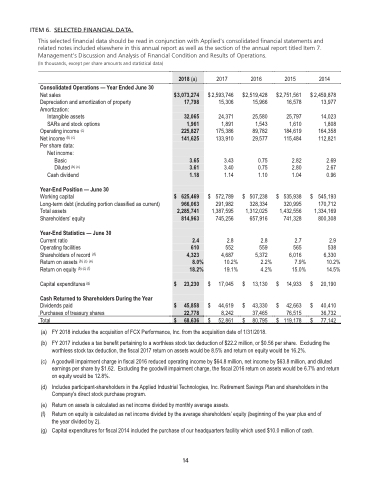

ITEM 6. SELECTED FINANCIAL DATA.

This selected financial data should be read in conjunction with Applied's consolidated financial statements and related notes included elsewhere in this annual report as well as the section of the annual report titled Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

(In thousands, except per share amounts and statistical data)

2018 (a)

$ 3,073,274 17,798

32,065 1,961 225,827 141,625

3.65 3.61 1.18

$ 625,469 966,063 2,285,741 814,963

2.4 610 4,323

8.0% 18.2%

23,230

45,858 22,778

$ $

$ 68,636

2014

2,459,878 13,977

14,023 1,808 164,358 112,821

2.69 2.67 0.96

545,193

170,712 1,334,169 800,308

2.9 538 6,330

10.2% 14.5%

20,190

40,410 36,732 77,142

(b) FY 2017 includes a tax benefit pertaining to a worthless stock tax deduction of $22.2 million, or $0.56 per share. Excluding the worthless stock tax deduction, the fiscal 2017 return on assets would be 8.5% and return on equity would be 16.2%.

(c) A goodwill impairment charge in fiscal 2016 reduced operating income by $64.8 million, net income by $63.8 million, and diluted earnings per share by $1.62. Excluding the goodwill impairment charge, the fiscal 2016 return on assets would be 6.7% and return on equity would be 12.8%.

(d) Includes participant-shareholders in the Applied Industrial Technologies, Inc. Retirement Savings Plan and shareholders in the Company's direct stock purchase program.

(e) Return on assets is calculated as net income divided by monthly average assets.

(f) Return on equity is calculated as net income divided by the average shareholders’ equity (beginning of the year plus end of the year divided by 2).

(g) Capital expenditures for fiscal 2014 included the purchase of our headquarters facility which used $10.0 million of cash.

Consolidated Operations — Year Ended June 30

Net sales

Depreciation and amortization of property Amortization:

Intangible assets

SARs and stock options Operating income (c)

Net income (b) (c)

Per share data:

Net income: Basic

Diluted (b) (c) Cash dividend

Year-End Position — June 30

Working capital

Long-term debt (including portion classified as current) Total assets

Shareholders’ equity

Year-End Statistics — June 30

Current ratio

Operating facilities Shareholders of record (d) Return on assets (b) (c) (e) Return on equity (b) (c) (f)

Capital expenditures (g)

Cash Returned to Shareholders During the Year

$

$

2017

2,593,746 15,306

24,371 1,891 175,386 133,910

3.43 3.40 1.14

572,789

291,982 1,387,595 745,256

2.8 552 4,687

10.2% 19.1%

17,045

44,619 8,242

2016 2015

$ 2,519,428 $ 2,751,561 15,966 16,578

25,580 25,797 1,543 1,610 89,782 184,619 29,577 115,484

0.75 2.82 0.75 2.80 1.10 1.04

$ 507,238 $ 535,938 328,334 320,995 1,312,025 1,432,556 657,916 741,328

Dividends paid

Purchases of treasury shares

Total $

52,861 $

(a) FY 2018 includes the acquisition of FCX Performance, Inc. from the acquisition date of 1/31/2018.

$

$

$

$

$

2.8 2.7 559 565 5,372 6,016

2.2% 7.9% 4.2% 15.0%

13,130 $ 14,933

$

$

43,330 $ 42,663 37,465 76,515 80,795 $ 119,178 $

$

14

14