Page 55 - 2018 Annual Report

P. 55

Table of Contents

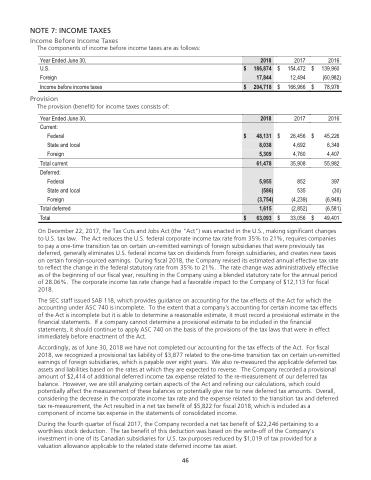

NOTE 7: INCOME TAXES

Income Before Income Taxes

The components of income before income taxes are as follows:

Year Ended June 30,

U.S. $ 154,472

2016 $ 139,960

2017

2018

$ 186,874 17,844

$ 204,718

Foreign

Income before income taxes

Provision

The provision (benefit) for income taxes consists of:

Year Ended June 30, Current:

Federal

State and local Foreign

Total current Deferred:

Federal

State and local Foreign

$

$

12,494 166,966

2017

26,456 4,692 4,760

35,908

852

535 (4,239) (2,852)

33,056 $

(60,982) 78,978

2016

45,226 6,349 4,407

55,982

397 (30) (6,948) (6,581)

49,401

$

$

2018

$ 48,131 8,038 5,309

61,478

5,955 (586) (3,754)

1,615

$ 63,093

Total deferred

Total $

On December 22, 2017, the Tax Cuts and Jobs Act (the "Act") was enacted in the U.S., making significant changes to U.S. tax law. The Act reduces the U.S. federal corporate income tax rate from 35% to 21%, requires companies to pay a one-time transition tax on certain un-remitted earnings of foreign subsidiaries that were previously tax deferred, generally eliminates U.S. federal income tax on dividends from foreign subsidiaries, and creates new taxes on certain foreign-sourced earnings. During fiscal 2018, the Company revised its estimated annual effective tax rate to reflect the change in the federal statutory rate from 35% to 21%. The rate change was administratively effective as of the beginning of our fiscal year, resulting in the Company using a blended statutory rate for the annual period of 28.06%. The corporate income tax rate change had a favorable impact to the Company of $12,113 for fiscal 2018.

The SEC staff issued SAB 118, which provides guidance on accounting for the tax effects of the Act for which the accounting under ASC 740 is incomplete. To the extent that a company's accounting for certain income tax effects of the Act is incomplete but it is able to determine a reasonable estimate, it must record a provisional estimate in the financial statements. If a company cannot determine a provisional estimate to be included in the financial statements, it should continue to apply ASC 740 on the basis of the provisions of the tax laws that were in effect immediately before enactment of the Act.

Accordingly, as of June 30, 2018 we have not completed our accounting for the tax effects of the Act. For fiscal 2018, we recognized a provisional tax liability of $3,877 related to the one-time transition tax on certain un-remitted earnings of foreign subsidiaries, which is payable over eight years. We also re-measured the applicable deferred tax assets and liabilities based on the rates at which they are expected to reverse. The Company recorded a provisional amount of $2,414 of additional deferred income tax expense related to the re-measurement of our deferred tax balance. However, we are still analyzing certain aspects of the Act and refining our calculations, which could potentially affect the measurement of these balances or potentially give rise to new deferred tax amounts. Overall, considering the decrease in the corporate income tax rate and the expense related to the transition tax and deferred tax re-measurement, the Act resulted in a net tax benefit of $5,822 for fiscal 2018, which is included as a component of income tax expense in the statements of consolidated income.

During the fourth quarter of fiscal 2017, the Company recorded a net tax benefit of $22,246 pertaining to a worthless stock deduction. The tax benefit of this deduction was based on the write-off of the Company's investment in one of its Canadian subsidiaries for U.S. tax purposes reduced by $1,019 of tax provided for a valuation allowance applicable to the related state deferred income tax asset.

46

46