Page 57 - 2018 Annual Report

P. 57

Table of Contents

management believes is more-likely-than-not of being realized. The realization of these deferred tax assets can be impacted by changes to tax laws, statutory rates and future income levels.

As a result of the Act, the Company’s net unremitted foreign earnings of $77,374 have been subject to U.S. taxation. As of June 30, 2018, all such undistributed earnings of non-U.S. subsidiaries are considered permanently reinvested. Therefore, no taxes have been provided that would result from the remittance of such earnings. The net amount of the unrecognized tax liability with respect to the distribution of these earnings is estimated to be approximately $1,986. In addition, we expect foreign tax credits would be available to either offset or partially reduce the tax cost in the event of a distribution.

Unrecognized Income Tax Benefits

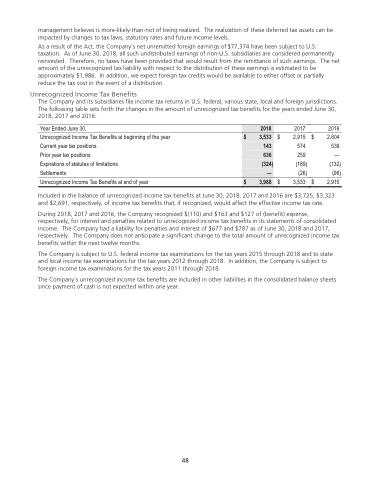

The Company and its subsidiaries file income tax returns in U.S. federal, various state, local and foreign jurisdictions. The following table sets forth the changes in the amount of unrecognized tax benefits for the years ended June 30, 2018, 2017 and 2016:

Year Ended June 30,

Unrecognized Income Tax Benefits at beginning of the year Current year tax positions

Prior year tax positions

Expirations of statutes of limitations

Settlements

Unrecognized Income Tax Benefits at end of year

$

$

2017 2016 2,915 $ 2,604 574 539 259 —

(189) (132) (26) (96)

3,533 $ 2,915

2018

$ 3,533 143 636

(324) —

$ 3,988

Included in the balance of unrecognized income tax benefits at June 30, 2018, 2017 and 2016 are $3,725, $3,323 and $2,691, respectively, of income tax benefits that, if recognized, would affect the effective income tax rate.

During 2018, 2017 and 2016, the Company recognized $(110) and $163 and $127 of (benefit) expense, respectively, for interest and penalties related to unrecognized income tax benefits in its statements of consolidated income. The Company had a liability for penalties and interest of $677 and $787 as of June 30, 2018 and 2017, respectively. The Company does not anticipate a significant change to the total amount of unrecognized income tax benefits within the next twelve months.

The Company is subject to U.S. federal income tax examinations for the tax years 2015 through 2018 and to state and local income tax examinations for the tax years 2012 through 2018. In addition, the Company is subject to foreign income tax examinations for the tax years 2011 through 2018.

The Company’s unrecognized income tax benefits are included in other liabilities in the consolidated balance sheets since payment of cash is not expected within one year.

48

48