Page 63 - 2018 Annual Report

P. 63

Table of Contents

coverage provided and are adjusted annually. Certain monthly health care premium payments are partially subsidized by the Company. Additionally, in conjunction with a fiscal 1998 acquisition, the Company assumed the obligation for a post-retirement medical benefit plan which provides health care benefits to eligible retired employees at no cost to the individual.

The Company uses a June 30 measurement date for all plans.

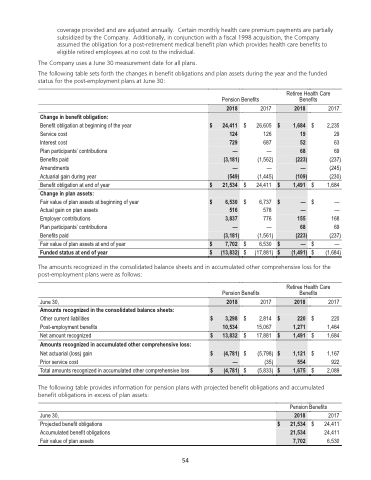

The following table sets forth the changes in benefit obligations and plan assets during the year and the funded status for the post-employment plans at June 30:

June 30,

Amounts recognized in the consolidated balance sheets:

Other current liabilities

Post-employment benefits

Net amount recognized

Amounts recognized in accumulated other comprehensive loss: Net actuarial (loss) gain

Prior service cost

Total amounts recognized in accumulated other comprehensive loss

$ $

$ $

2017

220 1,464 1,684

1,167 922 2,089

Pension Benefits

Retiree Health Care Benefits

2017

$ 2,235 29 63 69

(237) (245) (230)

$ 1,684

$ — — 168 69

(237) $ —

$ (1,684)

2018

2017

2018

$ 24,411 124 729 —

(3,181) —

(549)

$ 26,605 126 687 —

(1,562) —

(1,445)

$ 1,684 19 52 68

(223) —

(109)

$ 21,534

$ 24,411

$ 1,491

$ 6,530 516 3,837 —

(3,181)

$ 6,737 578 776 —

(1,561)

$— — 155 68

(223)

$ 7,702

$ 6,530

$—

$ (13,832)

$ (17,881)

$ (1,491)

Change in benefit obligation:

Benefit obligation at beginning of the year Service cost

Interest cost

Plan participants’ contributions

Benefits paid

Amendments

Actuarial gain during year

Benefit obligation at end of year

Change in plan assets:

Fair value of plan assets at beginning of year Actual gain on plan assets

Employer contributions

Plan participants’ contributions

Benefits paid

Fair value of plan assets at end of year Funded status at end of year

The amounts recognized in the consolidated balance sheets and in accumulated other comprehensive loss for the post-employment plans were as follows:

Pension Benefits

Retiree Health Care Benefits

2018

2017

2018

$ 3,298 10,534

$ 2,814 15,067

$ 220 1,271

$ 13,832

$ 17,881

$ 1,491

$ (4,781) —

$ (5,798) (35)

$ 1,121 554

$ (4,781)

$ (5,833)

$ 1,675

The following table provides information for pension plans with projected benefit obligations and accumulated benefit obligations in excess of plan assets:

June 30,

Projected benefit obligations Accumulated benefit obligations Fair value of plan assets

$

2017 24,411 24,411 6,530

Pension Benefits

2018

$ 21,534 21,534 7,702

54

54