Page 119 - Microsoft Word - CAFR Title Page

P. 119

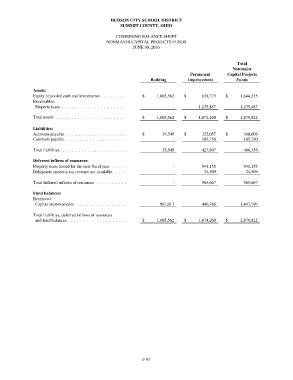

HUDSON CITY SCHOOL DISTRICT

SUMMIT COUNTY, OHIO

COMBINING BALANCE SHEET

NONMAJOR CAPITAL PROJECTS FUNDS

JUNE 30, 2016

Building Permanent Total

Improvement Nonmajor

Capital Projects

Funds

Assets: $ 1,005,562 $ 638,773 $ 1,644,335

Equity in pooled cash and investments . . . . . . . .

Receivables: - 1,235,487 1,235,487

Property taxes . . . . . . . . . . . . . . . . . . . .

$ 1,005,562 $ 1,874,260 $ 2,879,822

Total assets . . . . . . . . . . . . . . . . . . . . . .

$ 38,549 $ 322,057 $ 360,606

Liabilities:

Accounts payable . . . . . . . . . . . . . . . . . . . - 105,750 105,750

Contracts payable. . . . . . . . . . . . . . . . . . .

38,549 427,807 466,356

Total liabilities. . . . . . . . . . . . . . . . . . . . .

- 941,158 941,158

Deferred inflows of resources: - 24,509 24,509

Property taxes levied for the next fiscal year. . . . . .

Delinquent property tax revenue not available. . . . . - 965,667 965,667

Total deferred inflows of resources . . . . . . . . . . 967,013 480,786 1,447,799

Fund balances: $ 1,005,562 $ 1,874,260 $ 2,879,822

Restricted:

Capital improvements. . . . . . . . . . . . . . . . .

Total liabilities, deferred inflows of resources

and fund balances . . . . . . . . . . . . . . . . . . .

F 97