Page 88 - Microsoft Word - CAFR Title Page

P. 88

HUDSON CITY SCHOOL DISTRICT

SUMMIT COUNTY, OHIO

NOTES TO THE BASIC FINANCIAL STATEMENTS

FOR THE FISCAL YEAR ENDED JUNE 30, 2016

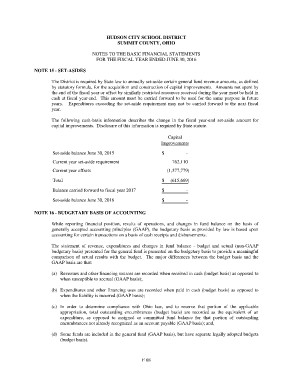

NOTE 15 - SET-ASIDES

The District is required by State law to annually set-aside certain general fund revenue amounts, as defined

by statutory formula, for the acquisition and construction of capital improvements. Amounts not spent by

the end of the fiscal year or offset by similarly restricted resources received during the year must be held in

cash at fiscal year-end. This amount must be carried forward to be used for the same purpose in future

years. Expenditures exceeding the set-aside requirement may not be carried forward to the next fiscal

year.

The following cash-basis information describes the change in the fiscal year-end set-aside amount for

capital improvements. Disclosure of this information is required by State statute.

Set-aside balance June 30, 2015 Capital

Current year set-aside requirement Improvements

Current year offsets $-

Total

Balance carried forward to fiscal year 2017 762,110

Set-aside balance June 30, 2016 (1,377,779)

$ (615,669)

$-

$-

NOTE 16 - BUDGETARY BASIS OF ACCOUNTING

While reporting financial position, results of operations, and changes in fund balance on the basis of

generally accepted accounting principles (GAAP), the budgetary basis as provided by law is based upon

accounting for certain transactions on a basis of cash receipts and disbursements.

The statement of revenue, expenditures and changes in fund balance - budget and actual (non-GAAP

budgetary basis) presented for the general fund is presented on the budgetary basis to provide a meaningful

comparison of actual results with the budget. The major differences between the budget basis and the

GAAP basis are that:

(a) Revenues and other financing sources are recorded when received in cash (budget basis) as opposed to

when susceptible to accrual (GAAP basis);

(b) Expenditures and other financing uses are recorded when paid in cash (budget basis) as opposed to

when the liability is incurred (GAAP basis);

(c) In order to determine compliance with Ohio law, and to reserve that portion of the applicable

appropriation, total outstanding encumbrances (budget basis) are recorded as the equivalent of an

expenditure, as opposed to assigned or committed fund balance for that portion of outstanding

encumbrances not already recognized as an account payable (GAAP basis); and,

(d) Some funds are included in the general fund (GAAP basis), but have separate legally adopted budgets

(budget basis).

F 68