Page 5 - The Panozzo Team - International Real Estate Guide

P. 5

Guide To

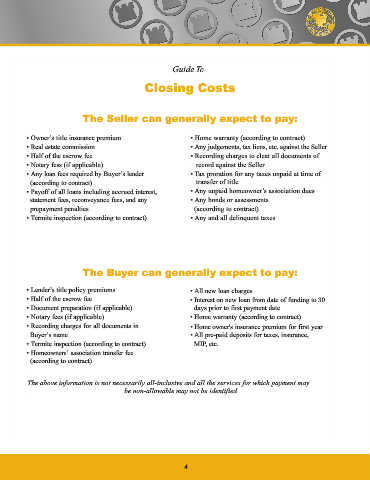

Closing Costs

The Seller can generally expect to pay:

• Owner’s title insurance premium •Home warranty (according to contract)

• Real estate commission • Any judgements, tax liens, etc. against the Seller

• Half of the escrow fee •Recording charges to clear all documents of

• Notary fess (if applicable) record against the Seller

• Any loan fees required by Buyer’s lender • Tax proration for any taxes unpaid at time of

(according to contract) transfer of title

• Payoff of all loans including accrued interest, • Any unpaid homeowner’s association dues

statement fees, reconveyance fees, and any • Any bonds or assessments

prepayment penalties (according to contract)

• Termite inspection (according to contract) • Any and all delinquent taxes

The Buyer can generally expect to pay:

•Lender’s title policy premiums • All new loan charges

• Half of the escrow fee • Interest on new loan from date of funding to 30

•Document preparation (if applicable) days prior to first payment date

• Notary fees (if applicable) • Home warranty (according to contract)

•Recording charges for all documents in • Home owner's insurance premium for first year

Buyer’s name • All pre-paid deposits for taxes, insurance,

• Termite inspection (according to contract) MIP, etc.

• Homeowners’ association transfer fee

(according to contract)

The above information is not necessarily all-inclusive and all the services for which payment may

be non-allowable may not be identified.

4