Page 24 - Bullion World Volume 02 Issue 11 November 2022_Neat

P. 24

Bullion World | Volume 2 | Issue 11 | November 2022

In particular, plain antique crafted continued preference for quasi- Urban India consumers have driven

gold bangles were exceptionally investment gold jewellery products. the recovery in gold jewellery

popular, underscoring the quasi- But challenges from the zero-COVID demand, as economic activity in

investment nature of gold jewellery policy can’t be overlooked. The these areas has normalised. Credit

demand. This is further implied national day holiday early in Q4 saw expansion has added impetus to

by the falling market share of 18k uneven gold jewellery demand, with this demand, with bank loan growth

gold, which offers a less compelling retailers in lockdown-stricken cities touching a nine-year high by quarter-

investment proposition to consumers disappointed. end.

who wish to preserve value through

high-carat jewellery. India We are positive in our outlook for

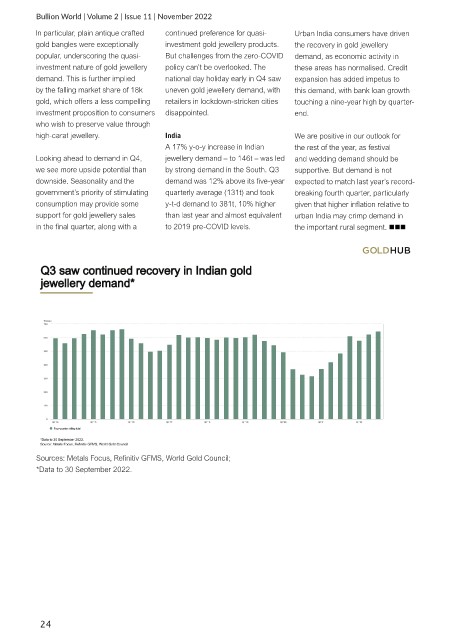

A 17% y-o-y increase in Indian the rest of the year, as festival

Looking ahead to demand in Q4, jewellery demand – to 146t – was led and wedding demand should be

we see more upside potential than by strong demand in the South. Q3 supportive. But demand is not

downside. Seasonality and the demand was 12% above its five-year expected to match last year’s record-

government’s priority of stimulating quarterly average (131t) and took breaking fourth quarter, particularly

consumption may provide some y-t-d demand to 381t, 10% higher given that higher inflation relative to

support for gold jewellery sales than last year and almost equivalent urban India may crimp demand in

in the final quarter, along with a to 2019 pre-COVID levels. the important rural segment.

Sources: Metals Focus, Refinitiv GFMS, World Gold Council;

*Data to 30 September 2022.

24

10-11-2022 11:35:50

BW Nov 2022.indd 24 10-11-2022 11:35:50

BW Nov 2022.indd 24