Page 18 - Bullion World Issue 11 March 2022_Neat

P. 18

Bullion World | Issue 11 | March 2022

Source: Bloomberg, Company Filings, ICE Benchmark Administration, World Gold Council

ETFs witnessed 9 tons inflows in 2021, taking total holdings to 38 tons. ETFs if you compare it with the overall

gold demand for India is a fraction, still, this seems to be catching the fancy of investors and there's something

the government also would like to see grow.

Source: IMF IFS, Reserve Bank of India, World Gold Council

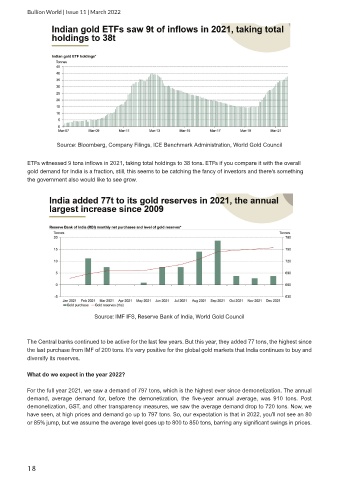

The Central banks continued to be active for the last few years. But this year, they added 77 tons, the highest since

the last purchase from IMF of 200 tons. It’s very positive for the global gold markets that India continues to buy and

diversify its reserves.

What do we expect in the year 2022?

For the full year 2021, we saw a demand of 797 tons, which is the highest ever since demonetization. The annual

demand, average demand for, before the demonetization, the five-year annual average, was 910 tons. Post

demonetization, GST, and other transparency measures, we saw the average demand drop to 720 tons. Now, we

have seen, at high prices and demand go up to 797 tons. So, our expectation is that in 2022, you'll not see an 80

or 85% jump, but we assume the average level goes up to 800 to 850 tons, barring any significant swings in prices.

18