Page 10 - Bullion World Issue 9 January 2022

P. 10

Bullion World | Issue 09 | January 2022

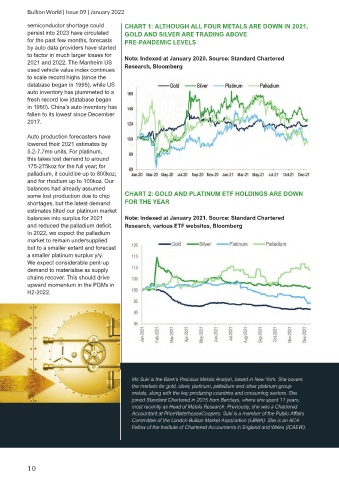

semiconductor shortage could CHART 1: ALTHOUGH ALL FOUR METALS ARE DOWN IN 2021,

persist into 2023 have circulated GOLD AND SILVER ARE TRADING ABOVE

for the past few months, forecasts PRE-PANDEMIC LEVELS

by auto data providers have started

to factor in much larger losses for Note: Indexed at January 2020. Source: Standard Chartered

2021 and 2022. The Manheim US Research, Bloomberg

used vehicle value index continues

to scale record highs (since the

database began in 1995), while US

auto inventory has plummeted to a

fresh record low (database began

in 1960). China’s auto inventory has

fallen to its lowest since December

2017.

Auto production forecasters have CHART 2: GOLD AND PLATINUM ETF HOLDINGS ARE DOWN

lowered their 2021 estimates by FOR THE YEAR

5.2-7.7mn units. For platinum,

this takes lost demand to around Note: Indexed at January 2021. Source: Standard Chartered

175-275koz for the full year; for Research, various ETF websites, Bloomberg

palladium, it could be up to 800koz;

and for rhodium up to 100koz. Our

balances had already assumed

some lost production due to chip

shortages, but the latest demand

estimates tilted our platinum market

balances into surplus for 2021

and reduced the palladium deficit.

In 2022, we expect the palladium

market to remain undersupplied

but to a smaller extent and forecast

a smaller platinum surplus y/y.

We expect considerable pent-up

demand to materialise as supply

chains recover. This should drive

upward momentum in the PGMs in

H2-2022.

Ms Suki is the Bank’s Precious Metals Analyst, based in New York. She covers

the markets for gold, silver, platinum, palladium and other platinum-group

metals, along with the key producing countries and consuming sectors. She

joined Standard Chartered in 2015 from Barclays, where she spent 11 years,

most recently as Head of Metals Research. Previously, she was a Chartered

Accountant at PriceWaterhouseCoopers. Suki is a member of the Public Affairs

Committee of the London Bullion Market Association (LBMA). She is an ACA

Fellow of the Institute of Chartered Accountants in England and Wales (ICAEW).

10