Page 20 - FY22_FOB_Guide_Final_Neat

P. 20

FOCUS ON BENEFITS 2022

Goodwill-Easter Seals Minnesota

OTHER VOLUNTARY BENEFITS

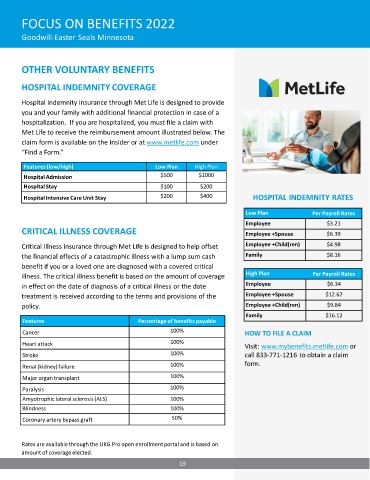

HOSPITAL INDEMNITY COVERAGE

Hospital indemnity insurance through Met Life is designed to provide

you and your family with additional financial protection in case of a

hospitalization. If you are hospitalized, you must file a claim with

Met Life to receive the reimbursement amount illustrated below. The

claim form is available on the Insider or at www.metlife.com under

“Find a Form.”

Features (low/high) Low Plan High Plan

Hospital Admission $500 $1000

Hospital Stay $100 $200

Hospital Intensive Care Unit Stay $200 $400 HOSPITAL INDEMNITY RATES

Low Plan Per Payroll Rates

Employee $3.21

CRITICAL ILLNESS COVERAGE Employee +Spouse $6.39

Critical Illness insurance through Met Life is designed to help offset Employee +Child(ren) $4.98

the financial effects of a catastrophic illness with a lump sum cash Family $8.16

benefit if you or a loved one are diagnosed with a covered critical

illness. The critical illness benefit is based on the amount of coverage High Plan Per Payroll Rates

in effect on the date of diagnosis of a critical illness or the date Employee $6.34

treatment is received according to the terms and provisions of the Employee +Spouse $12.62

policy. Employee +Child(ren) $9.84

Family $16.12

Features Percentage of benefits payable

Cancer 100% HOW TO FILE A CLAIM

Heart attack 100% Visit: www.mybenefits.metlife.com or

Stroke 100% call 833-771-1216 to obtain a claim

Renal (kidney) failure 100% form.

Major organ transplant 100%

Paralysis 100%

Amyotrophic lateral sclerosis (ALS) 100%

Blindness 100%

Coronary artery bypass graft 50%

Rates are available through the UKG Pro open enrollment portal and is based on

amount of coverage elected.

19