Page 21 - Taxation (TAX 112 A & B, BA-203)

P. 21

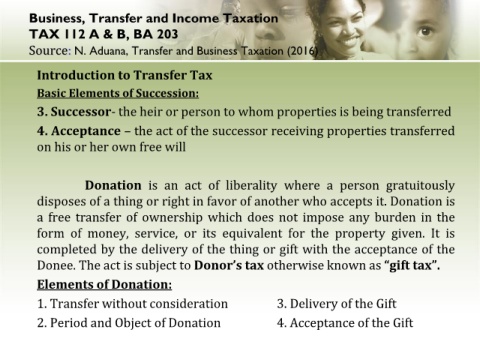

Business, Transfer and Income Taxation

TAX 112 A & B, BA 203

Source: N. Aduana, Transfer and Business Taxation (2016)

Introduction to Transfer Tax

Basic Elements of Succession:

3. Successor- the heir or person to whom properties is being transferred

4. Acceptance – the act of the successor receiving properties transferred

on his or her own free will

Donation is an act of liberality where a person gratuitously

disposes of a thing or right in favor of another who accepts it. Donation is

a free transfer of ownership which does not impose any burden in the

form of money, service, or its equivalent for the property given. It is

completed by the delivery of the thing or gift with the acceptance of the

Donee. The act is subject to Donor’s tax otherwise known as “gift tax”.

Elements of Donation:

1. Transfer without consideration 3. Delivery of the Gift

2. Period and Object of Donation 4. Acceptance of the Gift