Page 3 - Glossary of Terms flipbook

P. 3

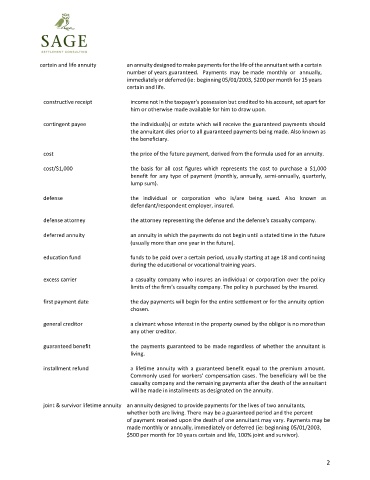

certain and life annuity an annuity designed to make payments for the life of the annuitant with a certain

number of years guaranteed. Payments may be made monthly or annually,

immediately or deferred (ie: beginning 05/01/2003, $200 per month for 15 years

certain and life.

constructive receipt income not in the taxpayer's possession but credited to his account, set apart for

him or otherwise made available for him to draw upon.

contingent payee the individual(s) or estate which will receive the guaranteed payments should

the annuitant dies prior to all guaranteed payments being made. Also known as

the beneficiary.

cost the price of the future payment, derived from the formula used for an annuity.

cost/$1,000 the basis for all cost figures which represents the cost to purchase a $1,000

benefit for any type of payment (monthly, annually, semi-annually, quarterly,

lump sum).

defense the individual or corporation who is/are being sued. Also known as

defendant/respondent employer, insured.

defense attorney the attorney representing the defense and the defense's casualty company.

deferred annuity an annuity in which the payments do not begin until a stated time in the future

(usually more than one year in the future).

education fund funds to be paid over a certain period, usually starting at age 18 and continuing

during the educational or vocational training years.

excess carrier a casualty company who insures an individual or corporation over the policy

limits of the firm's casualty company. The policy is purchased by the insured.

first payment date the day payments will begin for the entire settlement or for the annuity option

chosen.

general creditor a claimant whose interest in the property owned by the obligor is no more than

any other creditor.

guaranteed benefit the payments guaranteed to be made regardless of whether the annuitant is

living.

installment refund a lifetime annuity with a guaranteed benefit equal to the premium amount.

Commonly used for workers' compensation cases. The beneficiary will be the

casualty company and the remaining payments after the death of the annuitant

will be made in installments as designated on the annuity.

joint & survivor lifetime annuity an annuity designed to provide payments for the lives of two annuitants,

whether both are living. There may be a guaranteed period and the percent

of payment received upon the death of one annuitant may vary. Payments may be

made monthly or annually, immediately or deferred (ie: beginning 05/01/2003,

$500 per month for 10 years certain and life, 100% joint and survivor).

2