Page 285 - Data Science Algorithms in a Week

P. 285

266 Oloruntomi Joledo, Edgar Gutierrez and Hatim Bukhari

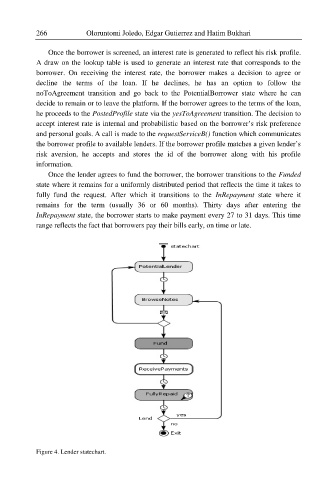

Once the borrower is screened, an interest rate is generated to reflect his risk profile.

A draw on the lookup table is used to generate an interest rate that corresponds to the

borrower. On receiving the interest rate, the borrower makes a decision to agree or

decline the terms of the loan. If he declines, he has an option to follow the

noToAgreement transition and go back to the PotentialBorrower state where he can

decide to remain or to leave the platform. If the borrower agrees to the terms of the loan,

he proceeds to the PostedProfile state via the yesToAgreement transition. The decision to

accept interest rate is internal and probabilistic based on the borrower’s risk preference

and personal goals. A call is made to the requestServiceB() function which communicates

the borrower profile to available lenders. If the borrower profile matches a given lender’s

risk aversion, he accepts and stores the id of the borrower along with his profile

information.

Once the lender agrees to fund the borrower, the borrower transitions to the Funded

state where it remains for a uniformly distributed period that reflects the time it takes to

fully fund the request. After which it transitions to the InRepayment state where it

remains for the term (usually 36 or 60 months). Thirty days after entering the

InRepayment state, the borrower starts to make payment every 27 to 31 days. This time

range reflects the fact that borrowers pay their bills early, on time or late.

Figure 4. Lender statechart.