Page 4 - GOODWILL QUESTIONS 12

P. 4

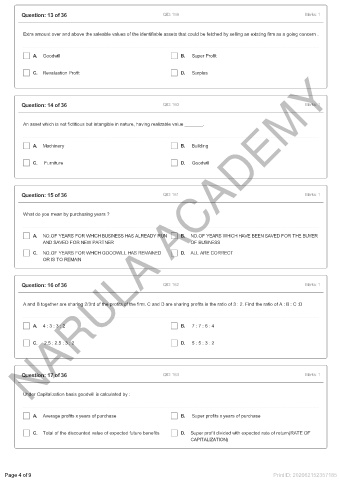

Question: 13 of 36 QID: 159 Marks: 1

Extra amount over and above the saleable values of the identifiable assets that could be fetched by selling an existing firm as a going concern .

A. Goodwill B. Super Profit

NARULA ACADEMY

C. Revaluation Profit D. Surplus

Question: 14 of 36 QID: 160 Marks: 1

An asset which is not fictitious but intangible in nature, having realizable value _______.

A. Machinery B. Building

C. Furniture D. Goodwill

Question: 15 of 36 QID: 161 Marks: 1

What do you mean by purchasing years ?

A. NO.OF YEARS FOR WHICH BUSINESS HAS ALREADY RUN B. NO.OF YEARS WHICH HAVE BEEN SAVED FOR THE BUYER

AND SAVED FOR NEW PARTNER OF BUSINESS

C. NO.OF YEARS FOR WHICH GOODWILL HAS REMAINED D. ALL ARE CORRECT

OR IS TO REMAIN

Question: 16 of 36 QID: 162 Marks: 1

A and B together are sharing 2/3rd of the profits of the firm. C and D are sharing profits in the ratio of 3 : 2. Find the ratio of A : B : C :D

A. 4 : 3 : 3 : 2 B. 7 : 7 : 6 : 4

C. 2.5 : 2.5 : 3 : 2 D. 5 : 5 : 3 : 2

Question: 17 of 36 QID: 163 Marks: 1

Under Capitalization basis goodwill is calculated by :

A. Average profits x years of purchase B. Super profits x years of purchase

C. Total of the discounted value of expected future benefits D. Super profit divided with expected rate of return(RATE OF

CAPITALIZATION)

Page 4 of 9 Print ID: 202062152357185