Page 18 - print collection sale.cdr

P. 18

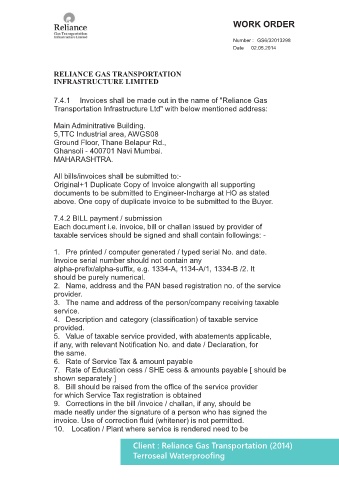

WORK ORDER

Number : GS6/32013298

Date 02.05.2014

RELIANCE GAS TRANSPORTATION

INFRASTRUCTURE LIMITED

7.4.1 Invoices shall be made out in the name of "Reliance Gas

Transportation Infrastructure Ltd" with below mentioned address:

Main Adminitrative Building.

5,TTC Industrial area, AWGS08

Ground Floor, Thane Belapur Rd.,

Ghansoli - 400701 Navi Mumbai.

MAHARASHTRA.

All bills/invoices shall be submitted to:-

Original+1 Duplicate Copy of Invoice alongwith all supporting

documents to be submitted to Engineer-Incharge at HO as stated

above. One copy of duplicate invoice to be submitted to the Buyer.

7.4.2 BILL payment / submission

Each document i.e. invoice, bill or challan issued by provider of

taxable services should be signed and shall contain followings: -

1. Pre printed / computer generated / typed serial No. and date.

Invoice serial number should not contain any

alpha-prefix/alpha-suffix, e.g. 1334-A, 1134-A/1, 1334-B /2. It

should be purely numerical.

2. Name, address and the PAN based registration no. of the service

provider.

3. The name and address of the person/company receiving taxable

service.

4. Description and category (classification) of taxable service

provided.

5. Value of taxable service provided, with abatements applicable,

if any, with relevant Notification No. and date / Declaration, for

the same.

6. Rate of Service Tax & amount payable

7. Rate of Education cess / SHE cess & amounts payable [ should be

shown separately ]

8. Bill should be raised from the office of the service provider

for which Service Tax registration is obtained

9. Corrections in the bill /invoice / challan, if any, should be

made neatly under the signature of a person who has signed the

invoice. Use of correction fluid (whitener) is not permitted.

10. Location / Plant where service is rendered need to be

Client : Reliance Gas Transportation (2014)

Terroseal Waterproofing