Page 54 - SABN AR 2021

P. 54

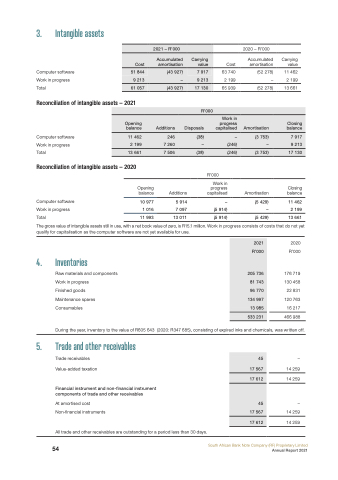

3. Intangible assets

2021 – R’000

Cost

Accumulated amortisation

Carrying value

51 844

(43 927)

7 917

9 213

–

9 213

61 057

(43 927)

17 130

Computer software Work in progress Total

Reconciliation of intangible assets – 2021

Computer software Work in progress Total

Reconciliation of intangible assets – 2020

Computer software Work in progress Total

Cost

63 740

2 199

65 939

2020 – R’000

Accumulated amortisation

(52 278) –

(52 278)

Carrying value

11 462

2 199

13 661

R’000

Opening balance

Additions

Disposals

Work in progress capitalised

Amortisation

Closing balance

11 462

246

(38)

–

(3 753)

7 917

2 199

7 260

–

(246)

–

9 213

13 661

7 506

(38)

(246)

(3 753)

17 130

R’000

Opening balance

10 977 1 016

11 993

Additions

5 914

7 097

13 011

Work in progress capitalised

– (5 914)

(5 914)

Amortisation

(5 429)

–

(5 429)

Closing balance

11 462 2 199

13 661

The gross value of intangible assets still in use, with a net book value of zero, is R15.1 million. Work in progress consists of costs that do not yet qualify for capitalisation as the computer software are not yet available for use.

2021

R’000

205 736

81 743

96 770

134 997

13 985

533 231

4. Inventories

Raw materials and components Work in progress

Finished goods

Maintenance spares Consumables

2020

R’000

176 719 130 458 22 831 120 763 16 217 466 988

During the year, inventory to the value of R605 643 (2020: R347 685), consisting of expired inks and chemicals, was written off.

5. Trade and other receivables

Trade receivables Value-added taxation

Financial instrument and non-financial instrument components of trade and other receivables

At amortised cost Non-financial instruments

All trade and other receivables are outstanding for a period less than 30 days.

– 14 259 14 259

– 14 259

14 259

South African Bank Note Company (RF) Proprietary Limited

45

17 567

17 612

45

17 567

17 612

54

Annual Report 2021