Page 55 - SABN AR 2021

P. 55

2021

R’000

3 451

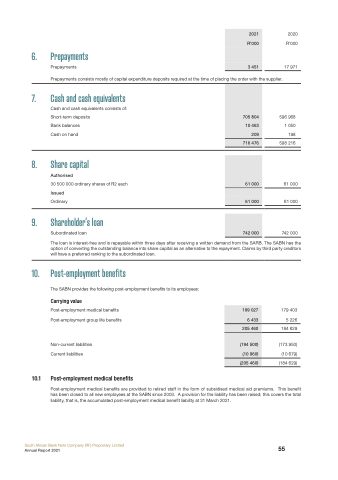

6. Prepayments

Prepayments

Prepayments consists mostly of capital expenditure deposits required at the time of placing the order with the supplier.

7. Cash and cash equivalents

Cash and cash equivalents consists of: Short-term deposits

Bank balances

Cash on hand

8. Share capital

Authorised

30 500 000 ordinary shares of R2 each

Issued

Ordinary

9. Shareholder’s loan

Subordinated loan

2020

R’000

17 971

705 804

10 463

209

716 476

596 968 1 050 198 598 216

61 000 61 000

742 000

61 000

61 000

742 000

The loan is interest-free and is repayable within three days after receiving a written demand from the SARB. The SABN has the option of converting the outstanding balance into share capital as an alternative to the repayment. Claims by third party creditors will have a preferred ranking to the subordinated loan.

10. Post-employment benefits

The SABN provides the following post-employment benefits to its employees:

Carrying value

Post-employment medical benefits Post-employment group life benefits

Non-current liabilities Current liabilities

10.1 Post-employment medical benefits

179 403 5 226

184 629

(173 950) (10 679)

(184 629)

199 027

6 433

205 460

(194 500)

(10 960)

(205 460)

Post-employment medical benefits are provided to retired staff in the form of subsidised medical aid premiums. This benefit has been closed to all new employees at the SABN since 2003. A provision for the liability has been raised; this covers the total liability, that is, the accumulated post-employment medical benefit liability at 31 March 2021.

South African Bank Note Company (RF) Proprietary Limited

Annual Report 2021

55