Page 58 - SABN AR 2021

P. 58

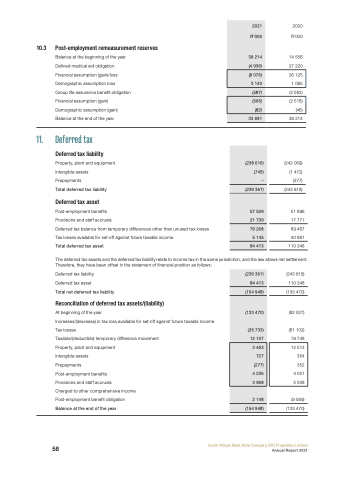

10.3 Post-employment remeasurement reserves

Balance at the beginning of the year Defined medical aid obligation Financial assumption (gain)/loss Demographic assumption loss

Group life assurance benefit obligation Financial assumption (gain) Demographic assumption (gain) Balance at the end of the year

11. Deferred tax

Deferred tax liability

Property, plant and equipment Intangible assets Prepayments

Total deferred tax liability

Deferred tax asset

Post-employment benefits

Provisions and staff accruals

Deferred tax balance from temporary differences other than unused tax losses Tax losses available for set-off against future taxable income

Total deferred tax asset

R’000

14 556 27 220

(2 562)

39 214

(242 069) (1 472) (277) (243 818)

51 696 17 771 69 467 40 881

110 348

2021

R’000

39 214

(4 936)

(8 076)

2020

3 140

(587)

(505)

(82)

33 691

(238 616)

(745)

–

(239 361)

57 529

21 739

79 268

5 145

84 413

The deferred tax assets and the deferred tax liability relate to income tax in the same jurisdiction, and the law allows net settlement. Therefore, they have been offset in the statement of financial position as follows:

Deferred tax liability

Deferred tax asset

Total net deferred tax liability

Reconciliation of deferred tax assets/(liability)

At beginning of the year

Increases/(decrease) in tax loss available for set-off against future taxable income Tax losses

Taxable/(deductible) temporary difference movement

Property, plant and equipment

Intangible assets

Prepayments

Post-employment benefits

Provisions and staff accruals

Charged to other comprehensive income

Post-employment benefit obligation

Balance at the end of the year

(243 818) 110 348 (133 470)

(82 527)

(61 102) 19 748

(9 589) (133 470)

(239 361)

84 413

(154 948)

(133 470)

(35 733)

12 107

3 453

727

(277)

4 236

3 968

2 148

(154 948)

58

South African Bank Note Company (RF) Proprietary Limited

26 125 1 095

(2 516) (46)

Annual Report 2021

12 513 354 352 4 021 2 508