Page 60 - SABN AR 2021

P. 60

2021

R’000

1 089 166

17 220

–

1 106 386

7 980

1 260

9 240

1 115 626

1 089 166

–

1 089 166

25 200

1 260

26 460

1 115 626

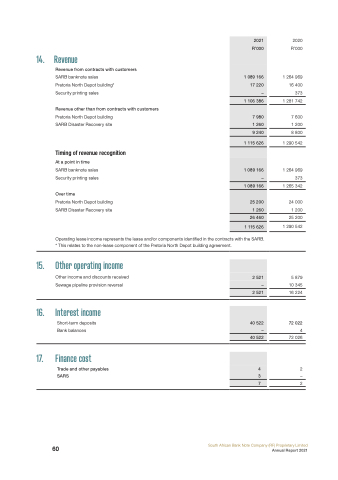

14. Revenue

Revenue from contracts with customers

SARB banknote sales Pretoria North Depot building* Security printing sales

Revenue other than from contracts with customers

Pretoria North Depot building SARB Disaster Recovery site

Timing of revenue recognition

At a point in time

SARB banknote sales Security printing sales

Over time

Pretoria North Depot building SARB Disaster Recovery site

Operating lease income represents the lease and/or components identified in the contracts with the SARB. * This relates to the non-lease component of the Pretoria North Depot building agreement.

2020

R’000

1 264 969 16 400 373 1 281 742

7 600 1 200 8 800

1 290 542

1 264 969 373 1 265 342

24 000 1 200 25 200 1 290 542

5 879 10 345 16 224

72 022

4 72 026

2 – 2

South African Bank Note Company (RF) Proprietary Limited

15. Other operating income

Other income and discounts received Sewage pipeline provision reversal

16. Interest income

Short-term deposits Bank balances

17. Finance cost

Trade and other payables SARS

2 521

–

2 521

40 522

–

40 522

4

3

7

60

Annual Report 2021