Page 62 - SABN AR 2021

P. 62

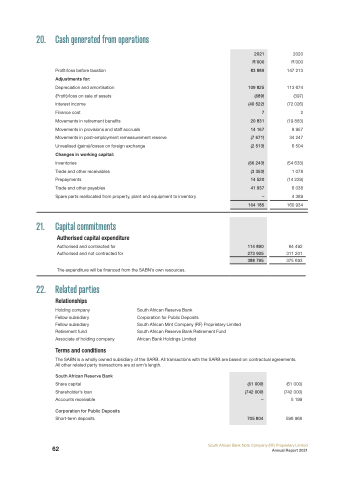

20. Cash generated from operations

2021

R’000

83 889

109 825

(689)

(40 522)

7

20 831

14 167

(7 671)

(2 513)

(66 243)

(3 353)

14 520

41 937

–

164 185

Profit/loss before taxation

Adjustments for:

Depreciation and amortisation (Profit)/loss on sale of assets Interest income

Finance cost

Movements in retirement benefits

Movements in provisions and staff accruals

Movements in post-employment remeasurement reserve

Unrealised (gains)/losses on foreign exchange

Changes in working capital:

Inventories

Trade and other receivables

Prepayments

Trade and other payables

Spare parts reallocated from property, plant and equipment to inventory

21. Capital commitments

Authorised capital expenditure

Authorised and contracted for Authorised and not contracted for

The expenditure will be financed from the SABN’s own resources.

2020

R’000

147 213

113 674 (397) (72 026) 2 (19 883) 8 957 34 247 6 504

(54 633) 1 078 (14 229) 6 038 4 389

160 934

64 492 311 201 375 693

114 890

273 905

388 795

22. Related parties

Relationships

Holding company

Fellow subsidiary

Fellow subsidiary

Retirement fund

Associate of holding company

Terms and conditions

South African Reserve Bank

Corporation for Public Deposits

South African Mint Company (RF) Proprietary Limited South African Reserve Bank Retirement Fund

African Bank Holdings Limited

The SABN is a wholly owned subsidiary of the SARB. All transactions with the SARB are based on contractual agreements. All other related party transactions are at arm’s length.

(61 000)

(742 000)

–

705 804

South African Reserve Bank

Share capital Shareholder’s loan Accounts receivable

Corporation for Public Deposits

Short-term deposits

(61 000) (742 000) 5 199

596 968

South African Bank Note Company (RF) Proprietary Limited

62

Annual Report 2021