Page 61 - SABN AR 2021

P. 61

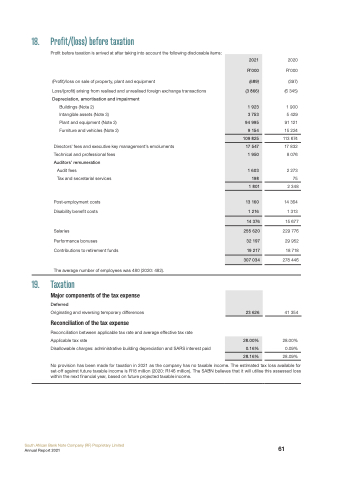

18. Profit/(loss) before taxation

Profit before taxation is arrived at after taking into account the following disclosable items:

(Profit)/loss on sale of property, plant and equipment

Loss/(profit) arising from realised and unrealised foreign exchange transactions

Depreciation, amortisation and impairment

Buildings (Note 2)

Intangible assets (Note 3) Plant and equipment (Note 2) Furniture and vehicles (Note 2)

Directors' fees and executive key management’s emoluments Technical and professional fees

Auditors’ remuneration

Audit fees

Tax and secretarial services

Post-employment costs Disability benefit costs

Salaries

Performance bonuses Contributions to retirement funds

The average number of employees was 480 (2020: 482).

19. Taxation

Major components of the tax expense

Deferred

Originating and reversing temporary differences

Reconciliation of the tax expense

Reconciliation between applicable tax rate and average effective tax rate Applicable tax rate

Disallowable charges: administrative building depreciation and SARS interest paid

2020

R’000

(397) (6 345)

1 900

5 429 91 121 15 224

113 674 17 832 8 076

2 273

75

2 348

14 364 1 313 15 677

229 776 29 952 18 718 278 446

41 354

28.00% 0.09% 28.09%

2021

R’000

(689)

(3 866)

1 923

3 753

94 995

9 154

109 825

17 547

1 950

1 603

198

1 801

13 160

1 216

14 376

255 620

32 197

19 217

307 034

23 626

28.00%

0.16%

28.16%

No provision has been made for taxation in 2021 as the company has no taxable income. The estimated tax loss available for set-off against future taxable income is R18 million (2020: R146 million). The SABN believes that it will utilise this assessed loss within the next financial year, based on future projected taxable income.

South African Bank Note Company (RF) Proprietary Limited

Annual Report 2021

61