Page 64 - SABN AR 2021

P. 64

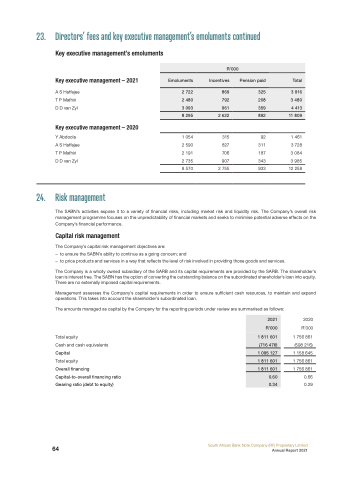

23. Directors’ fees and key executive management’s emoluments continued

Key executive management’s emoluments

Key executive management – 2021

A S Haffejee T P Mafhiri D D van Zyl

Key executive management – 2020

Y Abdoola A S Haffejee T P Mafhiri D D van Zyl

24. Risk management

1 054 2 590 2 191 2 735

8 570

315 92 827 311 706 187 907 343

2 755 933

1 461 3 728 3 084 3 985

12 258

R’000

Emoluments

Incentives

Pension paid

Total

2 722

869

325

3 916

2 480

792

208

3 480

3 093

961

359

4 413

8 295

2 622

892

11 809

The SABN’s activities expose it to a variety of financial risks, including market risk and liquidity risk. The Company’s overall risk management programme focuses on the unpredictability of financial markets and seeks to minimise potential adverse effects on the Company’s financial performance.

Capital risk management

The Company’s capital risk management objectives are:

– to ensure the SABN’s ability to continue as a going concern; and

– to price products and services in a way that reflects the level of risk involved in providing those goods and services.

The Company is a wholly owned subsidiary of the SARB and its capital requirements are provided by the SARB. The shareholder’s loan is interest free. The SABN has the option of converting the outstanding balance on the subordinated shareholder’s loan into equity. There are no externally imposed capital requirements.

Management assesses the Company’s capital requirements in order to ensure sufficient cash resources, to maintain and expand operations. This takes into account the shareholder’s subordinated loan.

The amounts managed as capital by the Company for the reporting periods under review are summarised as follows:

2021

R’000

1 811 601

(716 476)

1 095 127

1 811 601

1 811 601

0.60

0.34

Total equity

Cash and cash equivalents Capital

Total equity

Overall financing Capital-to-overall financing ratio Gearing ratio (debt to equity)

2020

R’000

1 756 861 (598 216) 1 158 645 1 756 861 1 756 861 0.66 0.29

South African Bank Note Company (RF) Proprietary Limited

64

Annual Report 2021