Page 65 - SABN AR 2021

P. 65

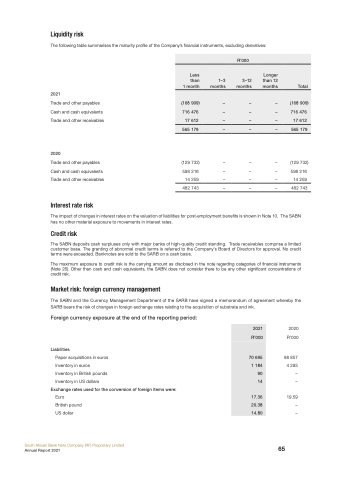

Liquidity risk

The following table summarises the maturity profile of the Company’s financial instruments, excluding derivatives:

R’000

Less than 1 month

1–3 months

3–12 months

Longer than 12 months

Total

(168 909)

–

–

–

(168 909)

716 476

–

–

–

716 476

17 612

–

–

–

17 612

565 179

–

–

–

565 179

2021

Trade and other payables Cash and cash equivalents Trade and other receivables

2020

Trade and other payables Cash and cash equivalents Trade and other receivables

Interest rate risk

(129 732) 598 216 14 259

482 743

– – – – – – – – –

– – –

(129 732) 598 216 14 259

482 743

The impact of changes in interest rates on the valuation of liabilities for post-employment benefits is shown in Note 10. The SABN has no other material exposure to movements in interest rates.

Credit risk

The SABN deposits cash surpluses only with major banks of high-quality credit standing. Trade receivables comprise a limited customer base. The granting of abnormal credit terms is referred to the Company’s Board of Directors for approval. No credit terms were exceeded. Banknotes are sold to the SARB on a cash basis.

The maximum exposure to credit risk is the carrying amount as disclosed in the note regarding categories of financial instruments (Note 26). Other than cash and cash equivalents, the SABN does not consider there to be any other significant concentrations of credit risk.

Market risk: foreign currency management

The SABN and the Currency Management Department of the SARB have signed a memorandum of agreement whereby the SARB bears the risk of changes in foreign exchange rates relating to the acquisition of substrate and ink.

Foreign currency exposure at the end of the reporting period:

Liabilities

Paper acquisitions in euros Inventory in euros Inventory in British pounds Inventory in US dollars

Exchange rates used for the conversion of foreign items were:

Euro

British pound US dollar

South African Bank Note Company (RF) Proprietary Limited

Annual Report 2021

2020

R’000

86 857 4 293 – –

19.59 – –

2021

R’000

70 695

1 184

90

14

17.36

20.38

14.80

65