Page 294 - B2B All Year Round Vol.8

P. 294

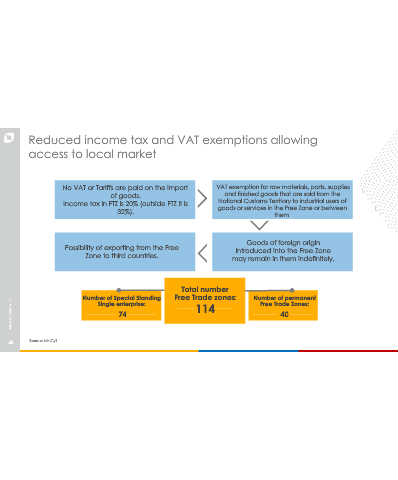

Reduced income tax and VAT exemptions allowing

access to local market

No VAT or Tariffs are paid on the import VAT exemption for raw materials, parts, supplies

of goods. and finished goods that are sold from the

National Customs Territory to industrial users of

Income tax in FTZ is 20% (outside FTZ it is goods or services in the Free Zone or between

32%). them.

Goods of foreign origin

Possibility of exporting from the Free introduced into the Free Zone

Zone to third countries. may remain in them indefinitely.

Total number

Number of Special Standing Free Trade zones: Number of permanent

Single enterprise: 114 Free Trade Zones:

74 40

45 Source: MinCyT