Page 14 - Montana Home Sellers Guide

P. 14

A9RE5A8.pdf 1 2/13/2019 1:00:49 PM

A9RE58F.pdf 1 2/13/2019 1:00:15 PM

A9RE546.pdf 1 2/13/2019 12:59:03 PM

A9R142.pdf 1 2/13/2019 12:18:03 PM

A9R13E.pdf 1 2/13/2019 12:17:05 PM

A9RE56C.pdf 1 2/13/2019 12:59:35 PM

A9RE5C1.pdf 1 2/13/2019 1:01:30 PM

FIRPTA

Understanding FIRPTA

QUALIFIED SUBSTITUTES, WITHHOLDING AND

OTHER MATTERS OF IMPORTANCE

FOR FULL ESCROW SERVICES, INCLUDING THE SERVICES OF A QUALIFIED SUBSTITUTE AND THE REMITTING OF THE

WITHHOLDING TAX AND THE RELATED FORMS TO THE IRS, CONTACT YOUR CHICAGO TITLE LOCAL OFFICES.

What is FIRPTA? What may a buyer

FIRPTA Withholding Rate Increased to 15% and seller do with a Certification

“FIRPTA” stands for the Foreign Investment in Real Property of Non-Foreign Status?

Act (Internal Revenue Code Section 1445). A Certification of Non-Foreign Status may be delivered to

Why is FIRPTA Important? a Qualified Substitute, that is, to a qualified third party

FIRPTA requires that a buyer of U.S. real property withhold a tax such as a title company, for safe storage and for availability

to the IRS for six years after closing.

if the seller is a foreign person or entity. Liability for

noncompliance may affect the buyer or the seller. Are there exemptions that may apply when the

C C C C C C C seller is foreign?

How may a buyer and a seller comply with FIRPTA

M M M M M M M

when the seller is non-foreign? In some circumstances when a seller is foreign, the

Y Y Y Y Y Y Y withholding tax will not apply or will apply at a reduced rate.

To inform the buyer that withholding is not required, the

CM

CM

CM

CM

CM

CM

CM

seller may use a Certification of Non-Foreign Status to

MY

MY

MY

MY

MY

MY

MY

certify under penalty of perjury that the seller is a non-foreign

CY CY CY CY CY CY CY

person or entity.

CMY

CMY

CMY

CMY

CMY

CMY

CMY

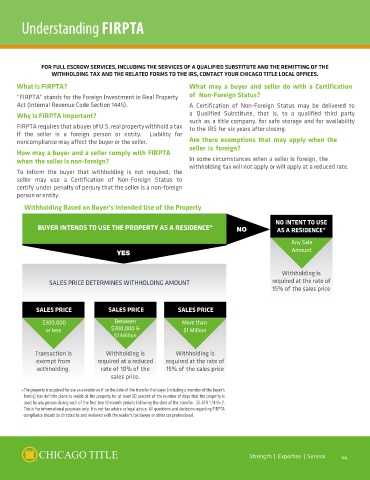

Withholding Based on Buyer’s Intended Use of the Property

K K K K K K K

NO INTENT TO USE

BUYER INTENDS TO USE THE PROPERTY AS A RESIDENCE* NO AS A RESIDENCE*

Any Sale

YES Amount

Withholding is

SALES PRICE DETERMINES WITHHOLDING AMOUNT required at the rate of

15% of the sales price

SALES PRICE SALES PRICE SALES PRICE

$300,000 Between More than

or less $300,000 & $1 Million

$1 Million

Transaction is Withholding is Withholding is

exempt from required at a reduced required at the rate of

withholding. rate of 10% of the 15% of the sales price

sales price.

* The property is acquired for use as a residence if on the date of the transfer the buyer (including a member of the buyer’s

family) has definite plans to reside at the property for at least 50 percent of the number of days that the property is

used by any person during each of the first two 12-month periods following the date of the transfer. 26 CFR 1.1445-2.

This is for informational purposes only. It is not tax advice or legal advice. All questions and decisions regarding FIRPTA

compliance should be directed to and reviewed with the reader's tax lawyer or other tax professional.

Strength | Expertise | Service 14