Page 42 - The Insurance Times May 2025

P. 42

Consumers

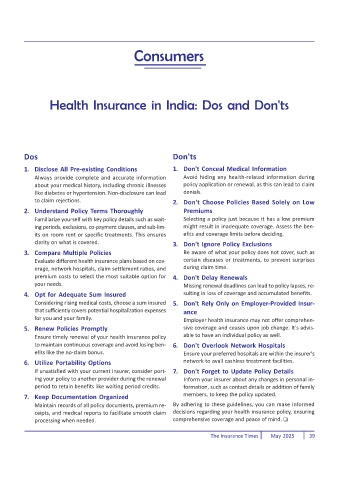

Health Insurance in India: Dos and Don'ts

Dos Don'ts

1. Disclose All Pre-existing Conditions 1. Don't Conceal Medical Information

Always provide complete and accurate information Avoid hiding any health-related information during

about your medical history, including chronic illnesses policy application or renewal, as this can lead to claim

like diabetes or hypertension. Non-disclosure can lead denials.

to claim rejections. 2. Don't Choose Policies Based Solely on Low

2. Understand Policy Terms Thoroughly Premiums

Familiarize yourself with key policy details such as wait- Selecting a policy just because it has a low premium

ing periods, exclusions, co-payment clauses, and sub-lim- might result in inadequate coverage. Assess the ben-

its on room rent or specific treatments. This ensures efits and coverage limits before deciding.

clarity on what is covered. 3. Don't Ignore Policy Exclusions

3. Compare Multiple Policies Be aware of what your policy does not cover, such as

Evaluate different health insurance plans based on cov- certain diseases or treatments, to prevent surprises

erage, network hospitals, claim settlement ratios, and during claim time.

premium costs to select the most suitable option for 4. Don't Delay Renewals

your needs. Missing renewal deadlines can lead to policy lapses, re-

4. Opt for Adequate Sum Insured sulting in loss of coverage and accumulated benefits.

Considering rising medical costs, choose a sum insured 5. Don't Rely Only on Employer-Provided Insur-

that sufficiently covers potential hospitalization expenses ance

for you and your family. Employer health insurance may not offer comprehen-

5. Renew Policies Promptly sive coverage and ceases upon job change. It's advis-

Ensure timely renewal of your health insurance policy able to have an individual policy as well.

to maintain continuous coverage and avoid losing ben- 6. Don't Overlook Network Hospitals

efits like the no-claim bonus. Ensure your preferred hospitals are within the insurer's

6. Utilize Portability Options network to avail cashless treatment facilities.

If unsatisfied with your current insurer, consider port- 7. Don't Forget to Update Policy Details

ing your policy to another provider during the renewal Inform your insurer about any changes in personal in-

period to retain benefits like waiting period credits. formation, such as contact details or addition of family

7. Keep Documentation Organized members, to keep the policy updated.

Maintain records of all policy documents, premium re- By adhering to these guidelines, you can make informed

ceipts, and medical reports to facilitate smooth claim decisions regarding your health insurance policy, ensuring

processing when needed. comprehensive coverage and peace of mind.

The Insurance Times May 2025 39