Page 23 - Insurance Times May 2020

P. 23

Further changes in fire underwriting

brought under gic re mid term treaty

endorsement dated 11/02/2020:

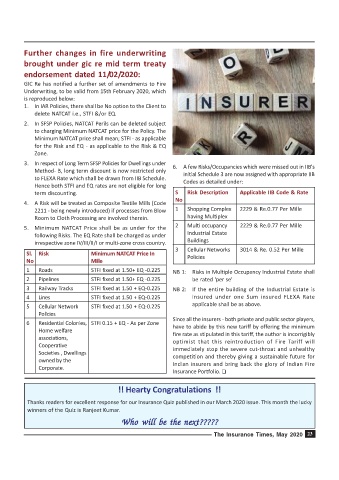

GIC Re has notified a further set of amendments to Fire

Underwriting, to be valid from 15th February 2020, which

is reproduced below:

1. In IAR Policies, there shall be No option to the Client to

delete NATCAT i.e., STFI &/or EQ.

2. In SFSP Policies, NATCAT Perils can be deleted subject

to charging Minimum NATCAT price for the Policy. The

Minimum NATCAT price shall mean; STFI - as applicable

for the Risk and EQ - as applicable to the Risk & EQ

Zone.

3. In respect of Long Term SFSP Policies for Dwellings under 6. A few Risks/Occupancies which were missed out in IIB's

Method- B, long term discount is now restricted only initial Schedule 3 are now assigned with appropriate IIB

to FLEXA Rate which shall be drawn from IIB Schedule. Codes as detailed under:

Hence both STFI and EQ rates are not eligible for long

term discounting. S Risk Description Applicable IIB Code & Rate

No

4. A Risk will be treated as Composite Textile Mills (Code

2211 - being newly introduced) if processes from Blow 1 Shopping Complex 2229 & Re.0.77 Per Mille

Room to Cloth Processing are involved therein. having Multiplex

5. Minimum NATCAT Price shall be as under for the 2 Multi occupancy 2229 & Re.0.77 Per Mille

following Risks. The EQ Rate shall be charged as under Industrial Estate

irrespective zone IV/III/II/I or multi-zone cross country. Buildings

3 Cellular Networks 3014 & Re. 0.52 Per Mille

Sl. Risk Minimum NATCAT Price In Policies

No Mille

1 Roads STFI fixed at 1.50+ EQ -0.225 NB 1: Risks in Multiple Occupancy Industrial Estate shall

2 Pipelines STFI fixed at 1.50+ EQ -0.225 be rated 'per se'

3 Railway Tracks STFI fixed at 1.50 + EQ-0.225 NB 2: If the entire building of the Industrial Estate is

4 Lines STFI fixed at 1.50 + EQ-0.225 insured under one Sum insured FLEXA Rate

5 Cellular Network STFI fixed at 1.50 + EQ-0.225 applicable shall be as above.

Policies

Since all the insurers - both private and public sector players,

6 Residential Colonies, STFI 0.15 + EQ - As per Zone have to abide by this new tariff by offering the minimum

Home welfare fire rate as stipulated in this tariff, the author is incorrigibly

associations,

optimist that this reintroduction of Fire Tariff will

Cooperative

Societies , Dwellings immediately stop the severe cut-throat and unhealthy

competition and thereby giving a sustainable future for

owned by the

Indian insurers and bring back the glory of Indian Fire

Corporate.

Insurance Portfolio. T

!! Hearty Congratulations !!

Thanks readers for excellent response for our Insurance Quiz published in our March 2020 issue. This month the lucky

winners of the Quiz is Ranjeet Kumar.

Who will be the next?????

Who will be the next?????

Who will be the next?????

Who will be the next?????

Who will be the next?????

The Insurance Times, May 2020 23