Page 2 - MARKETING & PUBLIC RELATIONS EBOOK IC88

P. 2

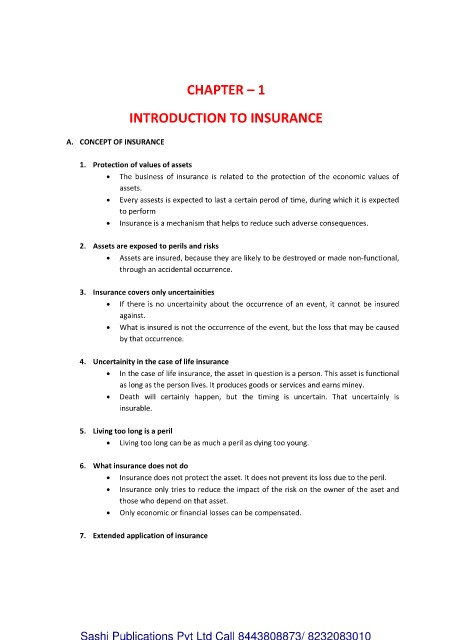

CHAPTER – 1

INTRODUCTION TO INSURANCE

A. CONCEPT OF INSURANCE

1. Protection of values of assets

The business of insurance is related to the protection of the economic values of

assets.

Every assests is expected to last a certain perod of time, during which it is expected

to perform

Insurance is a mechanism that helps to reduce such adverse consequences.

2. Assets are exposed to perils and risks

Assets are insured, because they are likely to be destroyed or made non-functional,

through an accidental occurrence.

3. Insurance covers only uncertainities

If there is no uncertainity about the occurrence of an event, it cannot be insured

against.

What is insured is not the occurrence of the event, but the loss that may be caused

by that occurrence.

4. Uncertainity in the case of life insurance

In the case of life insurance, the asset in question is a person. This asset is functional

as long as the person lives. It produces goods or services and earns miney.

Death will certainly happen, but the timing is uncertain. That uncertainly is

insurable.

5. Living too long is a peril

Living too long can be as much a peril as dying too young.

6. What insurance does not do

Insurance does not protect the asset. It does not prevent its loss due to the peril.

Insurance only tries to reduce the impact of the risk on the owner of the aset and

those who depend on that asset.

Only economic or financial losses can be compensated.

7. Extended application of insurance

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010