Page 51 - Insurance Times February 2021

P. 51

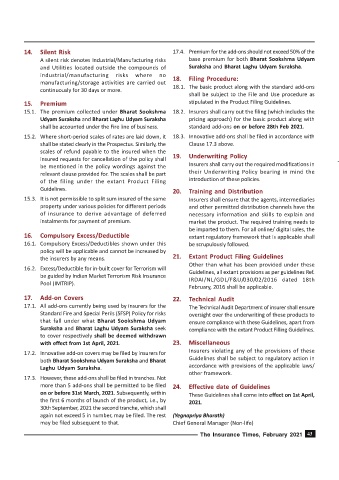

14. Silent Risk 17.4. Premium for the add-ons should not exceed 50% of the

A silent risk denotes Industrial/Manufacturing risks base premium for both Bharat Sookshma Udyam

and Utilities located outside the compounds of Suraksha and Bharat Laghu Udyam Suraksha.

industrial/manufacturing risks where no 18. Filing Procedure:

manufacturing/storage activities are carried out

continuously for 30 days or more. 18.1. The basic product along with the standard add-ons

shall be subject to the File and Use procedure as

15. Premium stipulated in the Product Filing Guidelines.

15.1. The premium collected under Bharat Sookshma 18.2. Insurers shall carry out the filing (which includes the

Udyam Suraksha and Bharat Laghu Udyam Suraksha pricing approach) for the basic product along with

shall be accounted under the Fire line of business. standard add-ons on or before 28th Feb 2021.

15.2. Where short-period scales of rates are laid down, it 18.3. Innovative add-ons shall be filed in accordance with

shall be stated clearly in the Prospectus. Similarly, the Clause 17.3 above.

scales of refund payable to the insured when the

insured requests for cancellation of the policy shall 19. Underwriting Policy

be mentioned in the policy wordings against the Insurers shall carry out the required modifications in

relevant clause provided for. The scales shall be part their Underwriting Policy bearing in mind the

of the filing under the extant Product Filing introduction of these policies.

Guidelines. 20. Training and Distribution

15.3. It is not permissible to split sum insured of the same Insurers shall ensure that the agents, intermediaries

property under various policies for different periods and other permitted distribution channels have the

of insurance to derive advantage of deferred necessary information and skills to explain and

instalments for payment of premium. market the product. The required training needs to

be imparted to them. For all online/ digital sales, the

16. Compulsory Excess/Deductible extant regulatory framework that is applicable shall

16.1. Compulsory Excess/Deductibles shown under this be scrupulously followed.

policy will be applicable and cannot be increased by

the insurers by any means. 21. Extant Product Filing Guidelines

Other than what has been provided under these

16.2. Excess/Deductible for in-built cover for Terrorism will Guidelines, all extant provisions as per guidelines Ref.

be guided by Indian Market Terrorism Risk Insurance

Pool (IMTRIP). IRDAI/NL/GDL/F&U/030/02/2016 dated 18th

February, 2016 shall be applicable.

17. Add-on Covers 22. Technical Audit

17.1. All add-ons currently being used by insurers for the The Technical Audit Department of insurer shall ensure

Standard Fire and Special Perils (SFSP) Policy for risks oversight over the underwriting of these products to

that fall under what Bharat Sookshma Udyam ensure compliance with these Guidelines, apart from

Suraksha and Bharat Laghu Udyam Suraksha seek compliance with the extant Product Filling Guidelines.

to cover respectively shall be deemed withdrawn

with effect from 1st April, 2021. 23. Miscellaneous

17.2. Innovative add-on covers may be filed by insurers for Insurers violating any of the provisions of these

both Bharat Sookshma Udyam Suraksha and Bharat Guidelines shall be subject to regulatory action in

Laghu Udyam Suraksha. accordance with provisions of the applicable laws/

other framework.

17.3. However, these add-ons shall be filed in tranches. Not

more than 5 add-ons shall be permitted to be filed 24. Effective date of Guidelines

on or before 31st March, 2021. Subsequently, within These Guidelines shall come into effect on 1st April,

the first 6 months of launch of the product, i.e., by 2021.

30th September, 2021 the second tranche, which shall

again not exceed 5 in number, may be filed. The rest (Yegnapriya Bharath)

may be filed subsequent to that. Chief General Manager (Non-life)

The Insurance Times, February 2021