Page 51 - Insurance Times September 2020

P. 51

Circular

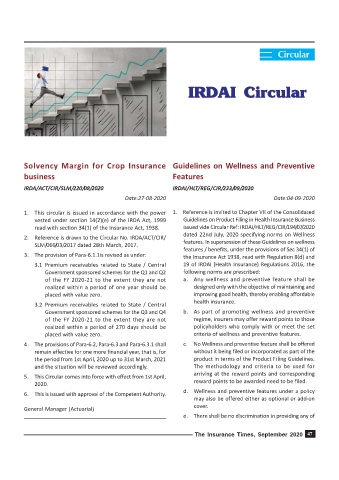

IRDAI Circular

Solvency Margin for Crop Insurance Guidelines on Wellness and Preventive

business Features

IRDA/ACT/CIR/SLM/220/08/2020 IRDAI/HLT/REG/CIR/233/09/2020

Date:27-08-2020 Date:04-09-2020

1. This circular is issued in accordance with the power 1. Reference is invited to Chapter VII of the Consolidated

vested under section 14(2)(e) of the IRDA Act, 1999 Guidelines on Product Filing in Health Insurance Business

read with section 34(1) of the Insurance Act, 1938. issued vide Circular Ref: IRDAI/HLT/REG/CIR/194/07/2020

dated 22nd July, 2020 specifying norms on Wellness

2. Reference is drawn to the Circular No. IRDA/ACT/CIR/

SLM/066/03/2017 dated 28th March, 2017. features. In supersession of these Guidelines on wellness

features / benefits, under the provisions of Sec 34(1) of

3. The provision of Para-6.1.1is revised as under: the Insurance Act 1938, read with Regulation 8(d) and

3.1 Premium receivables related to State / Central 19 of IRDAI (Health Insurance) Regulations 2016, the

Government sponsored schemes for the Q1 and Q2 following norms are prescribed:

of the FY 2020-21 to the extent they are not a. Any wellness and preventive feature shall be

realized within a period of one year should be designed only with the objective of maintaining and

placed with value zero. improving good health, thereby enabling affordable

health insurance.

3.2 Premium receivables related to State / Central

Government sponsored schemes for the Q3 and Q4 b. As part of promoting wellness and preventive

of the FY 2020-21 to the extent they are not regime, insurers may offer reward points to those

realized within a period of 270 days should be policyholders who comply with or meet the set

placed with value zero. criteria of wellness and preventive features.

4. The provisions of Para-6.2, Para-6.3 and Para-6.3.1 shall c. No Wellness and preventive feature shall be offered

remain effective for one more financial year, that is, for without it being filed or incorporated as part of the

the period from 1st April, 2020 up to 31st March, 2021 product in terms of the Product Filing Guidelines.

and the situation will be reviewed accordingly. The methodology and criteria to be used for

arriving at the reward points and corresponding

5. This Circular comes into force with effect from 1st April,

2020. reward points to be awarded need to be filed.

d. Wellness and preventive features under a policy

6. This is issued with approval of the Competent Authority.

may also be offered either as optional or add-on

cover.

General Manager (Actuarial)

e. There shall be no discrimination in providing any of

The Insurance Times, September 2020 47