Page 48 - The Insurance Times October 2025

P. 48

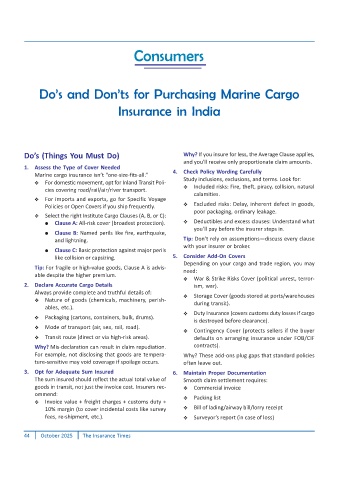

Consumers

Dos and Donts for Purchasing Marine Cargo

Insurance in India

Dos (Things You Must Do) Why? If you insure for less, the Average Clause applies,

and youll receive only proportionate claim amounts.

1. Assess the Type of Cover Needed

Marine cargo insurance isnt one-size-fits-all. 4. Check Policy Wording Carefully

For domestic movement, opt for Inland Transit Poli- Study inclusions, exclusions, and terms. Look for:

Included risks: Fire, theft, piracy, collision, natural

cies covering road/rail/air/river transport.

calamities.

For imports and exports, go for Specific Voyage

Policies or Open Covers if you ship frequently. Excluded risks: Delay, inherent defect in goods,

poor packaging, ordinary leakage.

Select the right Institute Cargo Clauses (A, B, or C):

Clause A: All-risk cover (broadest protection). Deductibles and excess clauses: Understand what

youll pay before the insurer steps in.

Clause B: Named perils like fire, earthquake,

and lightning. Tip: Dont rely on assumptionsdiscuss every clause

with your insurer or broker.

Clause C: Basic protection against major perils

like collision or capsizing. 5. Consider Add-On Covers

Depending on your cargo and trade region, you may

Tip: For fragile or high-value goods, Clause A is advis-

need:

able despite the higher premium.

War & Strike Risks Cover (political unrest, terror-

2. Declare Accurate Cargo Details ism, war).

Always provide complete and truthful details of: Storage Cover (goods stored at ports/warehouses

Nature of goods (chemicals, machinery, perish- during transit).

ables, etc.).

Duty Insurance (covers customs duty losses if cargo

Packaging (cartons, containers, bulk, drums).

is destroyed before clearance).

Mode of transport (air, sea, rail, road).

Contingency Cover (protects sellers if the buyer

Transit route (direct or via high-risk areas). defaults on arranging insurance under FOB/CIF

Why? Mis-declaration can result in claim repudiation. contracts).

For example, not disclosing that goods are tempera- Why? These add-ons plug gaps that standard policies

ture-sensitive may void coverage if spoilage occurs. often leave out.

3. Opt for Adequate Sum Insured 6. Maintain Proper Documentation

The sum insured should reflect the actual total value of Smooth claim settlement requires:

goods in transit, not just the invoice cost. Insurers rec- Commercial invoice

ommend:

Packing list

Invoice value + freight charges + customs duty +

10% margin (to cover incidental costs like survey Bill of lading/airway bill/lorry receipt

fees, re-shipment, etc.). Surveyors report (in case of loss)

44 October 2025 The Insurance Times