Page 53 - Insurance Times August New 2023

P. 53

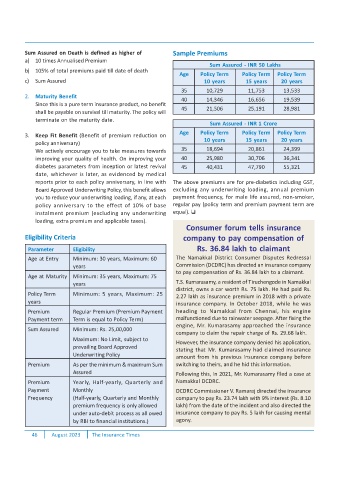

Sum Assured on Death is defined as higher of Sample Premiums

a) 10 times Annualised Premium

Sum Assured - INR 50 Lakhs

b) 105% of total premiums paid till date of death

Age Policy Term Policy Term Policy Term

c) Sum Assured 10 years 15 years 20 years

35 10,729 11,753 13,533

2. Maturity Benefit

40 14,346 16,656 19,539

Since this is a pure term insurance product, no benefit

45 21,506 25,191 28,981

shall be payable on survival till maturity. The policy will

terminate on the maturity date.

Sum Assured - INR 1 Crore

Age Policy Term Policy Term Policy Term

3. Keep Fit Benefit (Benefit of premium reduction on

10 years 15 years 20 years

policy anniversary)

35 18,694 20,861 24,399

We actively encourage you to take measures towards

improving your quality of health. On improving your 40 25,980 30,706 36,341

diabetes parameters from inception or latest revival 45 40,431 47,790 55,321

date, whichever is later, as evidenced by medical

reports prior to each policy anniversary, in line with The above premiums are for pre-diabetics including GST,

Board Approved Underwriting Policy, this benefit allows excluding any underwriting loading, annual premium

you to reduce your underwriting loading, if any, at each payment frequency, for male life assured, non-smoker,

policy anniversary to the effect of 10% of base regular pay (policy term and premium payment term are

instalment premium (excluding any underwriting equal).

loading, extra premium and applicable taxes).

Consumer forum tells insurance

Eligibility Criteria company to pay compensation of

Parameter Eligibility Rs. 36.84 lakh to claimant

Age at Entry Minimum: 30 years, Maximum: 60 The Namakkal District Consumer Disputes Redressal

years Commission (DCDRC) has directed an insurance company

to pay compensation of Rs. 36.84 lakh to a claimant.

Age at Maturity Minimum: 35 years, Maximum: 75

T.S. Kumarasamy, a resident of Tiruchengode in Namakkal

years

district, owns a car worth Rs. 75 lakh. He had paid Rs.

Policy Term Minimum: 5 years, Maximum: 25

2.27 lakh as insurance premium in 2018 with a private

years

insurance company. In October 2018, while he was

Premium Regular Premium (Premium Payment heading to Namakkal from Chennai, his engine

Payment term Term is equal to Policy Term) malfunctioned due to rainwater seepage. After fixing the

engine, Mr. Kumarasamy approached the insurance

Sum Assured Minimum: Rs. 25,00,000

company to claim the repair charge of Rs. 29.68 lakh.

Maximum: No Limit, subject to

However, the insurance company denied his application,

prevailing Board Approved

stating that Mr. Kumarasamy had claimed insurance

Underwriting Policy

amount from his previous insurance company before

Premium As per the minimum & maximum Sum switching to theirs, and he hid this information.

Assured

Following this, in 2021, Mr. Kumarasamy filed a case at

Premium Yearly, Half-yearly, Quarterly and Namakkal DCDRC.

Payment Monthly DCDRC Commissioner V. Ramaraj directed the insurance

Frequency (Half-yearly, Quarterly and Monthly company to pay Rs. 23.74 lakh with 9% interest (Rs. 8.10

premium frequency is only allowed lakh) from the date of the incident and also directed the

under auto-debit process as all owed insurance company to pay Rs. 5 lakh for causing mental

by RBI to financial institutions.) agony.

46 August 2023 The Insurance Times