Page 47 - Life Insurance Today January-June 2020

P. 47

requirement letters which were sent to DLA. As the death 4). This fact was known through the Claim form submit-

had taken place suddenly the Company had taken a stand ted by the claimant on 31.01.2016 wherein it was

of lapsed policy which is not sustainable. In view of the facts mentioned that the deceased had taken treatment of

and the circumstances the complaint is admitted. Diabetes from 17.05.2012 to 30.10.2012 from Dr.

Mukesh Chaudhari.

Taking into account the facts & circumstances, the Respon-

5). The Complainant had submitted a certificate of Dr.

dent is hereby directed to pay Rs.6,50,000/- to the Com- Mukesh Chaudhari wherein it had been mentioned that

plainant. the deceased L.A. was treated by him for diabetes

from 17.05.2012 to 30.10.2012.

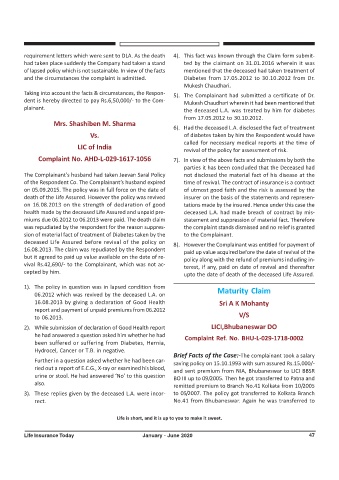

Mrs. Shashiben M. Sharma

6). Had the deceased L.A. disclosed the fact of treatment

Vs. of diabetes taken by him the Respondent would have

called for necessary medical reports at the time of

LIC of India

revival of the policy for assessment of risk.

Complaint No. AHD-L-029-1617-1056 7). In view of the above facts and submissions by both the

parties it has been concluded that the Deceased had

The Complainant’s husband had taken Jeevan Saral Policy not disclosed the material fact of his disease at the

of the Respondent Co. The Complainant’s husband expired time of revival. The contract of insurance is a contract

on 05.09.2015. The policy was in full force on the date of of utmost good faith and the risk is assessed by the

death of the Life Assured. However the policy was revived insurer on the basis of the statements and represen-

on 16.08.2013 on the strength of declaration of good tations made by the insured. Hence under this case the

health made by the deceased Life Assured and unpaid pre- deceased L.A. had made breach of contract by mis-

miums due 06.2012 to 06.2013 were paid. The death claim statement and suppression of material fact. Therefore

was repudiated by the respondent for the reason suppres- the complaint stands dismissed and no relief is granted

sion of material fact of treatment of Diabetes taken by the to the Complainant.

deceased Life Assured before revival of the policy on

8). However the Complainant was entitled for payment of

16.08.2013. The claim was repudiated by the Respondent

paid up value acquired before the date of revival of the

but it agreed to paid up value available on the date of re- policy along with the refund of premiums including in-

vival Rs.42,690/- to the Complainant, which was not ac- terest, if any, paid on date of revival and thereafter

cepted by him.

upto the date of death of the deceased Life Assured.

1). The policy in question was in lapsed condition from Maturity Claim

06.2012 which was revived by the deceased L.A. on

16.08.2013 by giving a declaration of Good Health Sri A K Mohanty

report and payment of unpaid premiums from 06.2012

to 06.2013. V/S

2). While submission of declaration of Good Health report LICI,Bhubaneswar DO

he had answered a question asked him whether he had

Complaint Ref. No. BHU-L-029-1718-0002

been suffered or suffering from Diabetes, Hernia,

Hydrocel, Cancer or T.B. in negative.

Brief Facts of the Case:-The complainant took a salary

Further in a question asked whether he had been car- saving policy on 15.10.1993 with sum assured Rs.15,000/-

ried out a report of E.C.G., X-ray or examined his blood,

and sent premium from NIA, Bhubaneswar to LICI BBSR

urine or stool. He had answered ‘No’ to this question

BO III up to 09/2005. Then he got transferred to Patna and

also. remitted premium to Branch No.41 Kolkata from 10/2005

3). These replies given by the deceased L.A. were incor- to 05/2007. The policy got transferred to Kolkata Branch

rect. No.41 from Bhubaneswar. Again he was transferred to

Life is short, and it is up to you to make it sweet.

Life Insurance Today January - June 2020 47