Page 44 - Banking Finance January 2024

P. 44

ARTICLE

as these offices/ institutes provide

consumer data through the AA pipeline.

4. Financial Information Users (FIU):

Institutes that provide personal finance

management, flow-based credit, and

wealth management services like Banks,

and NBFC are users of these data. The

inbuilt framework allows users/

consumers to choose whom to share

data with, what data they want to share,

for what time period, and for what

purpose and revoke. An FIU can also be

an FIP or vice versa.

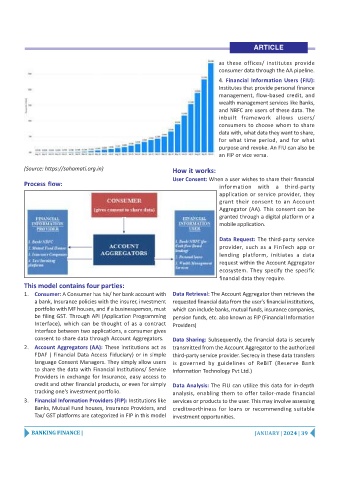

(Source: https://sahamati.org.in) How it works:

User Consent: When a user wishes to share their financial

Process flow:

information with a third-party

application or service provider, they

grant their consent to an Account

Aggregator (AA). This consent can be

granted through a digital platform or a

mobile application.

Data Request: The third-party service

provider, such as a FinTech app or

lending platform, initiates a data

request within the Account Aggregator

ecosystem. They specify the specific

financial data they require.

This model contains four parties:

1. Consumer: A Consumer has his/ her bank account with Data Retrieval: The Account Aggregator then retrieves the

a bank, Insurance policies with the insurer, investment requested financial data from the user's financial institutions,

portfolio with MF houses, and if a businessperson, must which can include banks, mutual funds, insurance companies,

be filing GST. Through API (Application Programming pension funds, etc. also known as FIP (Financial Information

Interface), which can be thought of as a contract Providers)

interface between two applications, a consumer gives

consent to share data through Account Aggregators. Data Sharing: Subsequently, the financial data is securely

2. Account Aggregators (AA): These institutions act as transmitted from the Account Aggregator to the authorized

FDAF ( Financial Data Access Fiduciary) or in simple third-party service provider. Secrecy in these data transfers

language Consent Managers. They simply allow users is governed by guidelines of ReBIT (Reserve Bank

to share the data with Financial Institutions/ Service Information Technology Pvt Ltd.)

Providers in exchange for Insurance, easy access to

credit and other financial products, or even for simply Data Analysis: The FIU can utilize this data for in-depth

tracking one's investment portfolio. analysis, enabling them to offer tailor-made financial

3. Financial Information Providers (FIP): Institutions like services or products to the user. This may involve assessing

Banks, Mutual Fund houses, Insurance Providers, and creditworthiness for loans or recommending suitable

Tax/ GST platforms are categorized in FIP in this model investment opportunities.

BANKING FINANCE | JANUARY | 2024 | 39