Page 43 - Banking Finance August 2021

P. 43

ARTICLE

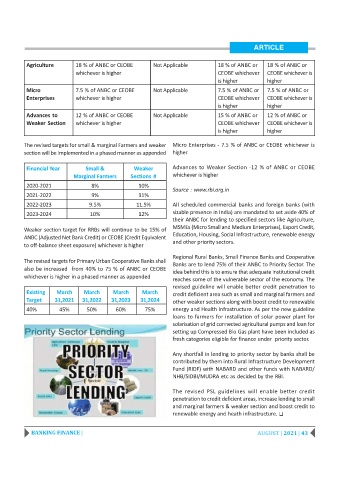

Agriculture 18 % of ANBC or CEOBE Not Applicable 18 % of ANBC or 18 % of ANBC or

whichever is higher CEOBE whichever CEOBE whichever is

is higher higher

Micro 7.5 % of ANBC or CEOBE Not Applicable 7.5 % of ANBC or 7.5 % of ANBC or

Enterprises whichever is higher CEOBE whichever CEOBE whichever is

is higher higher

Advances to 12 % of ANBC or CEOBE Not Applicable 15 % of ANBC or 12 % of ANBC or

Weaker Section whichever is higher CEOBE whichever CEOBE whichever is

is higher higher

The revised targets for small & marginal Farmers and weaker Micro Enterprises - 7.5 % of ANBC or CEOBE whichever is

section will be implemented in a phased manner as appended higher

Financial Year Small & Weaker Advances to Weaker Section -12 % of ANBC or CEOBE

Marginal Farmers Sections # whichever is higher

2020-2021 8% 10%

Source : www.rbi.org.in

2021-2022 9% 11%

2022-2023 9.5% 11.5% All scheduled commercial banks and foreign banks (with

2023-2024 10% 12% sizable presence in India) are mandated to set aside 40% of

their ANBC for lending to specified sectors like Agriculture,

Weaker section target for RRBs will continue to be 15% of MSMEs (Micro Small and Medium Enterprises), Export Credit,

Education, Housing, Social Infrastructure, renewable energy

ANBC (Adjusted Net Bank Credit) or CEOBE (Credit Equivalent

and other priority sectors.

to off-balance sheet exposure) whichever is higher

Regional Rural Banks, Small Finance Banks and Cooperative

The revised targets for Primary Urban Cooperative Banks shall

Banks are to lend 75% of their ANBC to Priority Sector. The

also be increased from 40% to 75 % of ANBC or CEOBE

idea behind this is to ensure that adequate institutional credit

whichever is higher in a phased manner as appended

reaches some of the vulnerable sector of the economy. The

revised guideline will enable better credit penetration to

Existing March March March March credit deficient area such as small and marginal farmers and

Target 31,2021 31,2022 31,2023 31,2024 other weaker sections along with boost credit to renewable

40% 45% 50% 60% 75% energy and Health Infrastructure. As per the new guideline

loans to farmers for installation of solar power plant for

solarisation of grid connected agricultural pumps and loan for

setting up Compressed Bio Gas plant have been included as

fresh categories eligible for finance under priority sector.

Any shortfall in lending to priority sector by banks shall be

contributed by them into Rural Infrastructure Development

Fund (RIDF) with NABARD and other funds with NABARD/

NHB/SIDBI/MUDRA etc as decided by the RBI.

The revised PSL guidelines will enable better credit

penetration to credit deficient areas, increase lending to small

and marginal farmers & weaker section and boost credit to

renewable energy and heath infrastructure. T

BANKING FINANCE | AUGUST | 2021 | 43