Page 51 - Banking Finance December 2020

P. 51

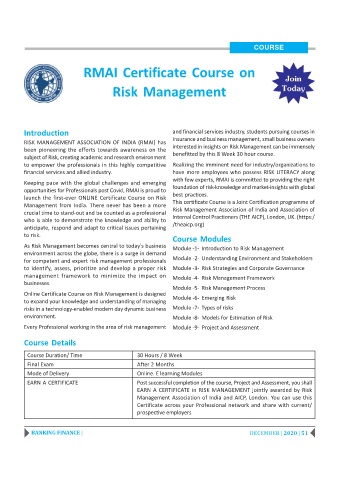

COURSE

RMAI Certificate Course on

Risk Management

Introduction and financial services industry, students pursuing courses in

insurance and business management, small business owners

RISK MANAGEMENT ASSOCIATION OF INDIA (RMAI) has

interested in insights on Risk Management can be immensely

been pioneering the efforts towards awareness on the

benefitted by this 8 Week 30 hour course.

subject of Risk, creating academic and research environment

to empower the professionals in this highly competitive Realizing the imminent need for industry/organizations to

financial services and allied industry. have more employees who possess RISK LITERACY along

with few experts, RMAI is committed to providing the right

Keeping pace with the global challenges and emerging

foundation of risk-knowledge and market-insights with global

opportunities for Professionals post Covid, RMAI is proud to

launch the first-ever ONLINE Certificate Course on Risk best practices.

This certificate Course is a Joint Certification programme of

Management from India. There never has been a more

Risk Management Association of India and Association of

crucial time to stand-out and be counted as a professional

who is able to demonstrate the knowledge and ability to Internal Control Practioners (THE AICP), London, UK. (https:/

anticipate, respond and adapt to critical issues pertaining /theaicp.org)

to risk.

Course Modules

As Risk Management becomes central to today's business

Module -1- Introduction to Risk Management

environment across the globe, there is a surge in demand

for competent and expert risk management professionals Module -2- Understanding Environment and Stakeholders

to identify, assess, prioritize and develop a proper risk Module -3- Risk Strategies and Corporate Governance

management framework to minimize the impact on Module -4- Risk Management Framework

businesses.

Module -5- Risk Management Process

Online Certificate Course on Risk Management is designed

to expand your knowledge and understanding of managing Module -6- Emerging Risk

risks in a technology-enabled modern day dynamic business Module -7- Types of risks

environment. Module -8- Models for Estimation of Risk

Every Professional working in the area of risk management Module -9- Project and Assessment

Course Details

Course Duration/ Time 30 Hours / 8 Week

Final Exam After 2 Months

Mode of Delivery Online. E learning Modules

EARN A CERTIFICATE Post successful completion of the course, Project and Assessment, you shall

EARN A CERTIFICATE in RISK MANAGEMENT jointly awarded by Risk

Management Association of India and AICP, London. You can use this

Certificate across your Professional network and share with current/

prospective employers

BANKING FINANCE | DECEMBER | 2020 | 51