Page 174 - IC38 GENERAL INSURANCE

P. 174

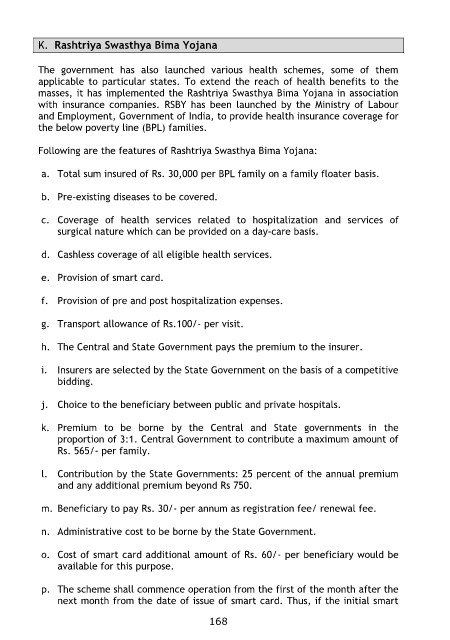

K. Rashtriya Swasthya Bima Yojana

The government has also launched various health schemes, some of them

applicable to particular states. To extend the reach of health benefits to the

masses, it has implemented the Rashtriya Swasthya Bima Yojana in association

with insurance companies. RSBY has been launched by the Ministry of Labour

and Employment, Government of India, to provide health insurance coverage for

the below poverty line (BPL) families.

Following are the features of Rashtriya Swasthya Bima Yojana:

a. Total sum insured of Rs. 30,000 per BPL family on a family floater basis.

b. Pre-existing diseases to be covered.

c. Coverage of health services related to hospitalization and services of

surgical nature which can be provided on a day-care basis.

d. Cashless coverage of all eligible health services.

e. Provision of smart card.

f. Provision of pre and post hospitalization expenses.

g. Transport allowance of Rs.100/- per visit.

h. The Central and State Government pays the premium to the insurer.

i. Insurers are selected by the State Government on the basis of a competitive

bidding.

j. Choice to the beneficiary between public and private hospitals.

k. Premium to be borne by the Central and State governments in the

proportion of 3:1. Central Government to contribute a maximum amount of

Rs. 565/- per family.

l. Contribution by the State Governments: 25 percent of the annual premium

and any additional premium beyond Rs 750.

m. Beneficiary to pay Rs. 30/- per annum as registration fee/ renewal fee.

n. Administrative cost to be borne by the State Government.

o. Cost of smart card additional amount of Rs. 60/- per beneficiary would be

available for this purpose.

p. The scheme shall commence operation from the first of the month after the

next month from the date of issue of smart card. Thus, if the initial smart

168