Page 27 - IC38 GENERAL INSURANCE

P. 27

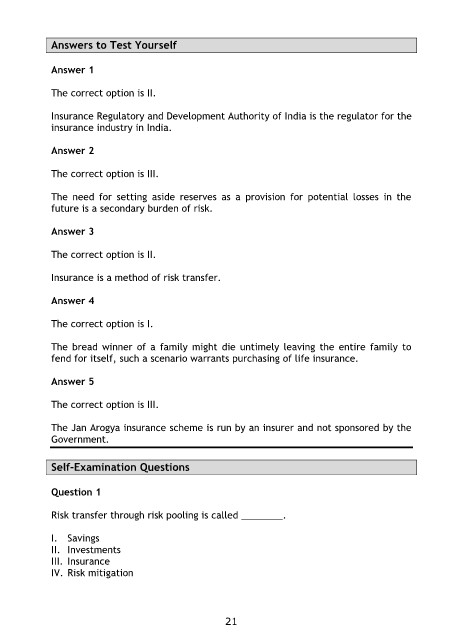

Answers to Test Yourself

Answer 1

The correct option is II.

Insurance Regulatory and Development Authority of India is the regulator for the

insurance industry in India.

Answer 2

The correct option is III.

The need for setting aside reserves as a provision for potential losses in the

future is a secondary burden of risk.

Answer 3

The correct option is II.

Insurance is a method of risk transfer.

Answer 4

The correct option is I.

The bread winner of a family might die untimely leaving the entire family to

fend for itself, such a scenario warrants purchasing of life insurance.

Answer 5

The correct option is III.

The Jan Arogya insurance scheme is run by an insurer and not sponsored by the

Government.

Self-Examination Questions

Question 1

Risk transfer through risk pooling is called ________.

I. Savings

II. Investments

III. Insurance

IV. Risk mitigation

21