Page 273 - IC38 GENERAL INSURANCE

P. 273

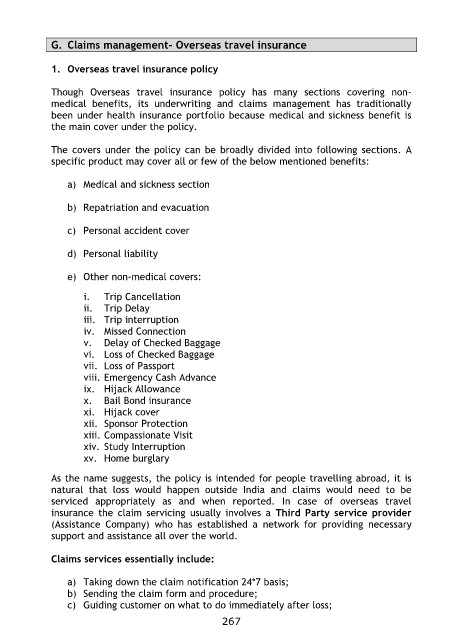

G. Claims management- Overseas travel insurance

1. Overseas travel insurance policy

Though Overseas travel insurance policy has many sections covering non-

medical benefits, its underwriting and claims management has traditionally

been under health insurance portfolio because medical and sickness benefit is

the main cover under the policy.

The covers under the policy can be broadly divided into following sections. A

specific product may cover all or few of the below mentioned benefits:

a) Medical and sickness section

b) Repatriation and evacuation

c) Personal accident cover

d) Personal liability

e) Other non-medical covers:

i. Trip Cancellation

ii. Trip Delay

iii. Trip interruption

iv. Missed Connection

v. Delay of Checked Baggage

vi. Loss of Checked Baggage

vii. Loss of Passport

viii. Emergency Cash Advance

ix. Hijack Allowance

x. Bail Bond insurance

xi. Hijack cover

xii. Sponsor Protection

xiii. Compassionate Visit

xiv. Study Interruption

xv. Home burglary

As the name suggests, the policy is intended for people travelling abroad, it is

natural that loss would happen outside India and claims would need to be

serviced appropriately as and when reported. In case of overseas travel

insurance the claim servicing usually involves a Third Party service provider

(Assistance Company) who has established a network for providing necessary

support and assistance all over the world.

Claims services essentially include:

a) Taking down the claim notification 24*7 basis;

b) Sending the claim form and procedure;

c) Guiding customer on what to do immediately after loss;

267