Page 310 - IC38 GENERAL INSURANCE

P. 310

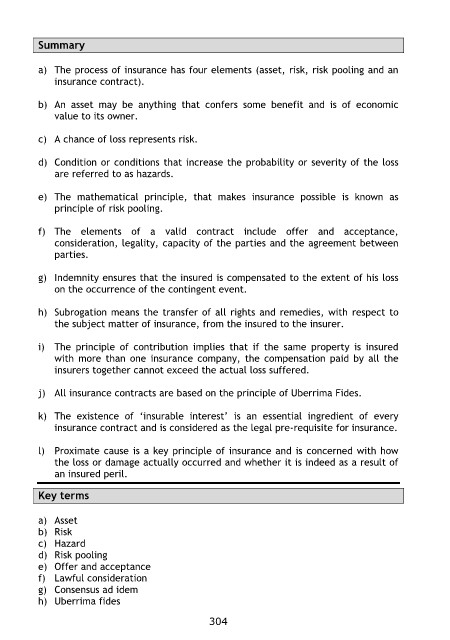

Summary

a) The process of insurance has four elements (asset, risk, risk pooling and an

insurance contract).

b) An asset may be anything that confers some benefit and is of economic

value to its owner.

c) A chance of loss represents risk.

d) Condition or conditions that increase the probability or severity of the loss

are referred to as hazards.

e) The mathematical principle, that makes insurance possible is known as

principle of risk pooling.

f) The elements of a valid contract include offer and acceptance,

consideration, legality, capacity of the parties and the agreement between

parties.

g) Indemnity ensures that the insured is compensated to the extent of his loss

on the occurrence of the contingent event.

h) Subrogation means the transfer of all rights and remedies, with respect to

the subject matter of insurance, from the insured to the insurer.

i) The principle of contribution implies that if the same property is insured

with more than one insurance company, the compensation paid by all the

insurers together cannot exceed the actual loss suffered.

j) All insurance contracts are based on the principle of Uberrima Fides.

k) The existence of „insurable interest‟ is an essential ingredient of every

insurance contract and is considered as the legal pre-requisite for insurance.

l) Proximate cause is a key principle of insurance and is concerned with how

the loss or damage actually occurred and whether it is indeed as a result of

an insured peril.

Key terms

a) Asset

b) Risk

c) Hazard

d) Risk pooling

e) Offer and acceptance

f) Lawful consideration

g) Consensus ad idem

h) Uberrima fides

304