Page 374 - IC38 GENERAL INSURANCE

P. 374

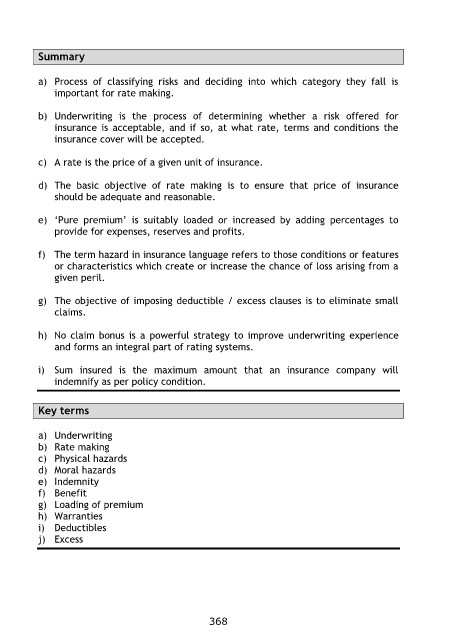

Summary

a) Process of classifying risks and deciding into which category they fall is

important for rate making.

b) Underwriting is the process of determining whether a risk offered for

insurance is acceptable, and if so, at what rate, terms and conditions the

insurance cover will be accepted.

c) A rate is the price of a given unit of insurance.

d) The basic objective of rate making is to ensure that price of insurance

should be adequate and reasonable.

e) „Pure premium‟ is suitably loaded or increased by adding percentages to

provide for expenses, reserves and profits.

f) The term hazard in insurance language refers to those conditions or features

or characteristics which create or increase the chance of loss arising from a

given peril.

g) The objective of imposing deductible / excess clauses is to eliminate small

claims.

h) No claim bonus is a powerful strategy to improve underwriting experience

and forms an integral part of rating systems.

i) Sum insured is the maximum amount that an insurance company will

indemnify as per policy condition.

Key terms

a) Underwriting

b) Rate making

c) Physical hazards

d) Moral hazards

e) Indemnity

f) Benefit

g) Loading of premium

h) Warranties

i) Deductibles

j) Excess

368