Page 423 - IC38 GENERAL INSURANCE

P. 423

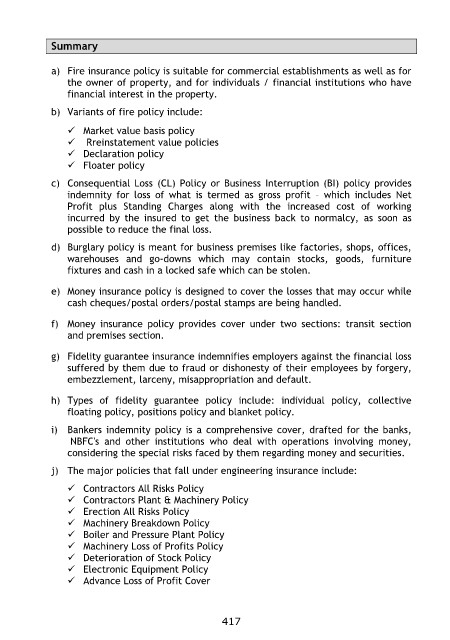

Summary

a) Fire insurance policy is suitable for commercial establishments as well as for

the owner of property, and for individuals / financial institutions who have

financial interest in the property.

b) Variants of fire policy include:

Market value basis policy

Rreinstatement value policies

Declaration policy

Floater policy

c) Consequential Loss (CL) Policy or Business Interruption (BI) policy provides

indemnity for loss of what is termed as gross profit – which includes Net

Profit plus Standing Charges along with the increased cost of working

incurred by the insured to get the business back to normalcy, as soon as

possible to reduce the final loss.

d) Burglary policy is meant for business premises like factories, shops, offices,

warehouses and go-downs which may contain stocks, goods, furniture

fixtures and cash in a locked safe which can be stolen.

e) Money insurance policy is designed to cover the losses that may occur while

cash cheques/postal orders/postal stamps are being handled.

f) Money insurance policy provides cover under two sections: transit section

and premises section.

g) Fidelity guarantee insurance indemnifies employers against the financial loss

suffered by them due to fraud or dishonesty of their employees by forgery,

embezzlement, larceny, misappropriation and default.

h) Types of fidelity guarantee policy include: individual policy, collective

floating policy, positions policy and blanket policy.

i) Bankers indemnity policy is a comprehensive cover, drafted for the banks,

NBFC's and other institutions who deal with operations involving money,

considering the special risks faced by them regarding money and securities.

j) The major policies that fall under engineering insurance include:

Contractors All Risks Policy

Contractors Plant & Machinery Policy

Erection All Risks Policy

Machinery Breakdown Policy

Boiler and Pressure Plant Policy

Machinery Loss of Profits Policy

Deterioration of Stock Policy

Electronic Equipment Policy

Advance Loss of Profit Cover

417