Page 31 - Banking Finance July 2025

P. 31

ARTICLE

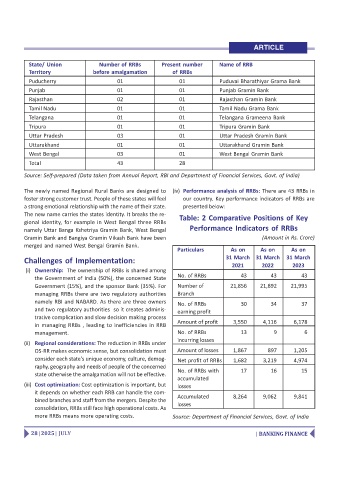

State/ Union Number of RRBs Present number Name of RRB

Territory before amalgamation of RRBs

Puducherry 01 01 Puduvai Bharathiyar Grama Bank

Punjab 01 01 Punjab Gramin Bank

Rajasthan 02 01 Rajasthan Gramin Bank

Tamil Nadu 01 01 Tamil Nadu Grama Bank

Telangana 01 01 Telangana Grameena Bank

Tripura 01 01 Tripura Gramin Bank

Uttar Pradesh 03 01 Uttar Pradesh Gramin Bank

Uttarakhand 01 01 Uttarakhand Gramin Bank

West Bengal 03 01 West Bengal Gramin Bank

Total 43 28

Source: Self-prepared (Data taken from Annual Report, RBI and Department of Financial Services, Govt. of India)

The newly named Regional Rural Banks are designed to (iv) Performance analysis of RRBs: There are 43 RRBs in

foster strong customer trust. People of these states will feel our country. Key performance indicators of RRBs are

a strong emotional relationship with the name of their state. presented below:

The new name carries the states identity. It breaks the re- Table: 2 Comparative Positions of Key

gional identity, for example in West Bengal three RRBs

namely Uttar Banga Kshetriya Gramin Bank, West Bengal Performance Indicators of RRBs

Gramin Bank and Bangiya Gramin Vikash Bank have been (Amount in Rs. Crore)

merged and named West Bengal Gramin Bank.

Particulars As on As on As on

Challenges of Implementation: 31 March 31 March 31 March

2021 2022 2023

(i) Ownership: The ownership of RRBs is shared among

No. of RRBs 43 43 43

the Government of India (50%), the concerned State

Government (15%), and the sponsor Bank (35%). For Number of 21,856 21,892 21,995

managing RRBs there are two regulatory authorities Branch

namely RBI and NABARD. As there are three owners No. of RRBs 30 34 37

and two regulatory authorities so it creates adminis- earning profit

trative complication and slow decision making process

in managing RRBs , leading to inefficiencies in RRB Amount of profit 3,550 4,116 6,178

management. No. of RRBs 13 9 6

incurring losses

(ii) Regional considerations: The reduction in RRBs under

OS-RR makes economic sense, but consolidation must Amount of losses 1,867 897 1,205

consider each state's unique economy, culture, demog- Net profit of RRBs 1,682 3,219 4,974

raphy, geography and needs of people of the concerned

No. of RRBs with 17 16 15

state otherwise the amalgamation will not be effective.

accumulated

(iii) Cost optimization: Cost optimization is important, but losses

it depends on whether each RRB can handle the com-

Accumulated 8,264 9,062 9,841

bined branches and staff from the mergers. Despite the

losses

consolidation, RRBs still face high operational costs. As

more RRBs means more operating costs. Source: Department of Financial Services, Govt. of India

28 | 2025 | JULY | BANKING FINANCE