Page 39 - Banking Finance November 2019

P. 39

ARTICLE

B. If the instrument will or may be understanding of financial instrument as per IND AS vis Indian GAAP :-

settled in the issuer's own equity 1. Statutory Liability- Not a financial instrument as per IND AS

instrument it is: 2. Advance for purchase of goods - Not a financial instrument as per IND AS

Y A non- derivative that include

no contractual obligation for 3. Liability for damages under a court case - Not a financial instrument as per

the issuer to deliver a variable IND AS.

number of its own equity 4. USD - INR Option in the books of option buyer - A financial instrument and

instrument an asset in the books of option buyer.

or 5. Trade Receivable - Financial Asset.

Y A Derivative that will be 6. Gold Bullion - Not a financial instrument as per IND AS as no contractual

settled only "by the issuer" obligation.

exchanging a fixed amount of 7. Advance payment of tax - Not a financial instrument as per IND AS as no

cash or another financial asset contractual obligation.

for a fixed number of its own

equity instruments.

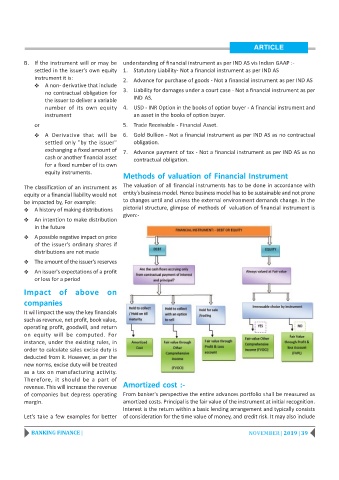

Methods of valuation of Financial Instrument

The classification of an instrument as The valuation of all financial instruments has to be done in accordance with

equity or a financial liability would not entity's business model. Hence business model has to be sustainable and not prone

be impacted by, For example: to changes until and unless the external environment demands change. In the

Y A history of making distributions pictorial structure, glimpse of methods of valuation of financial instrument is

given:-

Y An intention to make distribution

in the future

Y A possible negative impact on price

of the issuer's ordinary shares if

distributions are not made

Y The amount of the issuer's reserves

Y An issuer's expectations of a profit

or loss for a period

Impact of above on

companies

It will impact the way the key financials

such as revenue, net profit, book value,

operating profit, goodwill, and return

on equity will be computed. For

instance, under the existing rules, in

order to calculate sales excise duty is

deducted from it. However, as per the

new norms, excise duty will be treated

as a tax on manufacturing activity.

Therefore, it should be a part of

revenue. This will increase the revenue Amortized cost :-

of companies but depress operating From banker's perspective the entire advances portfolio shall be measured as

margin. amortized costs. Principal is the fair value of the instrument at initial recognition.

Interest is the return within a basic lending arrangement and typically consists

Let's take a few examples for better of consideration for the time value of money, and credit risk. It may also include

BANKING FINANCE | NOVEMBER | 2019 | 39