Page 56 - Insurance Times April 2019

P. 56

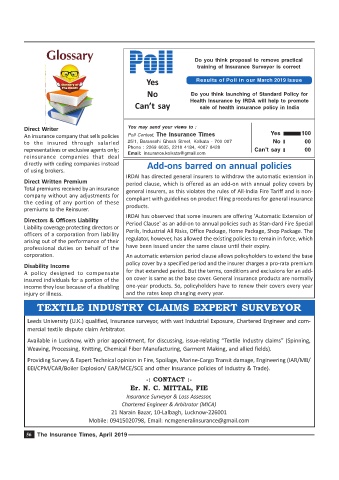

Poll Do you think proposal to remove practical

Glossary

training of Insurance Surveyor is correct

Yes Results of Poll in our March 2019 Issue

No Do you think launching of Standard Policy for

Health Insurance by IRDA will help to promote

Can’t say sale of health insurance policy in India

Direct Writer You may send your views to :

An insurance company that sells policies Poll Contest, The Insurance Times Yes 100

to the insured through salaried 25/1, Baranashi Ghosh Street, Kolkata - 700 007 No 00

representatives or exclusive agents only; Phone : 2269 6035, 2218 4184, 4007 8428 Can’t say 00

Email: insurance.kolkata@gmail.com

reinsurance companies that deal

directly with ceding companies instead Add-ons barred on annual policies

of using brokers.

IRDAI has directed general insurers to withdraw the automatic extension in

Direct Written Premium period clause, which is offered as an add-on with annual policy covers by

Total premiums received by an insurance general insurers, as this violates the rules of All-India Fire Tariff and is non-

company without any adjustments for compliant with guidelines on product filing procedures for general insurance

the ceding of any portion of these

premiums to the Reinsurer. products.

IRDAI has observed that some insurers are offering 'Automatic Extension of

Directors & Officers Liability Period Clause' as an add-on to annual policies such as Stan-dard Fire Special

Liability coverage protecting directors or Perils, Industrial All Risks, Office Package, Home Package, Shop Package. The

officers of a corporation from liability

arising out of the performance of their regulator, however, has allowed the existing policies to remain in force, which

professional duties on behalf of the have been issued under the same clause until their expiry.

corporation. An automatic extension period clause allows policyholders to extend the base

policy cover by a specified period and the insurer charges a pro-rata premium

Disability Income

A policy designed to compensate for that extended period. But the terms, conditions and exclusions for an add-

insured individuals for a portion of the on cover is same as the base cover. General insurance products are normally

income they lose because of a disabling one-year products. So, policyholders have to renew their covers every year

injury or illness. and the rates keep changing every year.

TEXTILE INDUSTRY CLAIMS EXPERT SURVEYOR

Leeds University (U.K.) qualified, Insurance surveyor, with vast Industrial Exposure, Chartered Engineer and com-

mercial textile dispute claim Arbitrator.

Available in Lucknow, with prior appointment, for discussing, issue-relating “Textile Industry claims” (Spinning,

Weaving, Processing, Knitting, Chemical Fiber Manufacturing, Garment Making, and allied fields).

Providing Survey & Expert Technical opinion in Fire, Spoilage, Marine-Cargo Transit damage, Engineering (IAR/MB/

EEI/CPM/CAR/Boiler Explosion/ EAR/MCE/SCE and other Insurance policies of Industry & Trade).

-: CONTACT :-

Er. N. C. MITTAL, FIE

Insurance Surveyor & Loss Assessor,

Chartered Engineer & Arbitrator (MICA)

21 Narain Bazar, 10-Lalbagh, Lucknow-226001

Mobile: 09415020798, Email: ncmgeneralinsurance@gmail.com

56 The Insurance Times, April 2019