Page 15 - Insurance Times November 2022

P. 15

recognise reality or ability to meet the under the ambit of this definition. Com-

Bajaj Allianz's new glo-

ordinary demands of life, mental condi- plications relating to disorders of intoxi-

tions associated with the abuse of alco- cation, dependence, abuse, and with- bal health insurance

hol and drugs." drawal caused by alcohol and other sub-

policy

stances will also not be considered un-

Medical insurance will therefore cover

Bajaj Allianz has recently launched

der the mental health insurance.

treatment of mental diseases that fall

its 'Global Health Care' product,

which pays for medical expenses

ICICI Lombard launches 14 new products incurred within India as well as

ICICI Lombard, launched its latest line-up of 14 new or enhanced insurance overseas. Global health insurance

solutions, including riders/add-ons and upgrades across Health, Motor, Travel policies not only cover medical

and Corporate segments. The slew of offerings, announced at a press emergencies when you are travel-

conference in Mumbai on Friday, offers a comprehensive array of products ling overseas but also if you are trav-

across categories for a wide spectrum of customers. The product suite shall elling specifically to seek treatment.

transform the way consumers experience insurance, providing them a

Bajaj Allianz's Global Health Care

seamless journey and tech-enabled solutions.

product pays for in-patient

The insurance industry is now seeing new types of risks emerging, be it hospitalisation bills, pre- and post-

pandemic, climate change or data privacy and this calls for comprehensive hospitalisation charges, road and

coverage steered by the changing customer behaviour and driven by the air ambulance, out-patient treat-

advent of new technological solutions and opportunities. This was the core ment, day-care procedures, living

thought behind the new offerings and propelled by the recent revolutionary donor expenses and mental illness

announcement of ‘Use and File’ framework from the IRDAI. treatment, among other things.

You can choose between its Impe-

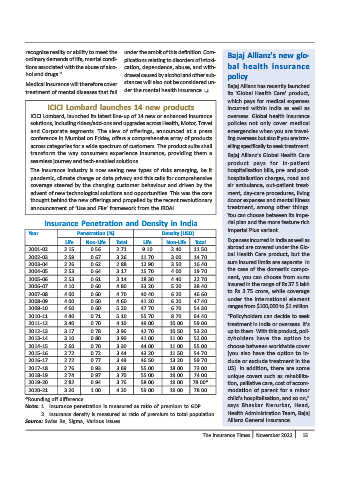

Insurance Penetration and Density in India rial plan and the more feature-rich

Imperial Plus variant.

Year Penetration (%) Density (USD)

Expenses incurred in India as well as

Life Non-Life Total Life Non-Life Total

abroad are covered under the Glo-

2001-02 2.15 0.56 2.71 9.10 2.40 11.50

bal Health Care product, but the

2002-03 2.59 0.67 3.26 11.70 3.00 14.70

sum insured limits are separate. In

2003-04 2.26 0.62 2.88 12.90 3.50 16.40

the case of the domestic compo-

2004-05 2.53 0.64 3.17 15.70 4.00 19.70

nent, you can choose from sums

2005-06 2.53 0.61 3.14 18.30 4.40 22.70

insured in the range of Rs 37.5 lakh

2006-07 4.10 0.60 4.80 33.20 5.20 38.40

to Rs 3.75 crore, while coverage

2007-08 4.00 0.60 4.70 40.40 6.20 46.60

under the international element

2008-09 4.00 0.60 4.60 41.20 6.20 47.40

ranges from $100,000 to $1 million.

2009-10 4.60 0.60 5.20 47.70 6.70 54.30

2010-11 4.40 0.71 5.10 55.70 8.70 64.40 "Policyholders can decide to seek

2011-12 3.40 0.70 4.10 49.00 10.00 59.00 treatment in India or overseas. It's

2012-13 3.17 0.78 3.96 42.70 10.50 53.20 up to them. With this product, poli-

2013-14 3.10 0.80 3.90 41.00 11.00 52.00 cyholders have the option to

2014-15 2.60 0.70 3.30 44.00 11.00 55.00 choose between worldwide cover

2015-16 2.72 0.72 3.44 43.20 11.50 54.70 (you also have the option to in-

2016-17 2.72 0.77 3.49 46.50 13.20 59.70 clude or exclude treatment in the

2017-18 2.76 0.93 3.69 55.00 18.00 73.00 US). In addition, there are some

2018-19 2.74 0.97 3.70 55.00 19.00 74.00 unique covers such as rehabilita-

2019-20 2.82 0.94 3.76 58.00 19.00 78.00* tion, palliative care, cost of accom-

2020-21 3.20 1.00 4.20 59.00 19.00 78.00 modation of parent for a minor

*Rounding off difference child's hospitalisation, and so on,"

Note: 1. Insurance penetration is measured as ratio of premium to GDP. says Bhaskar Nerurkar, Head,

2. Insurance density is measured as ratio of premium to total population. Health Administration Team, Bajaj

Source: Swiss Re, Sigma, Various Issues Allianz General Insurance.

The Insurance Times November 2022 13