Page 29 - Banking Finance August 2023

P. 29

ARTICLE

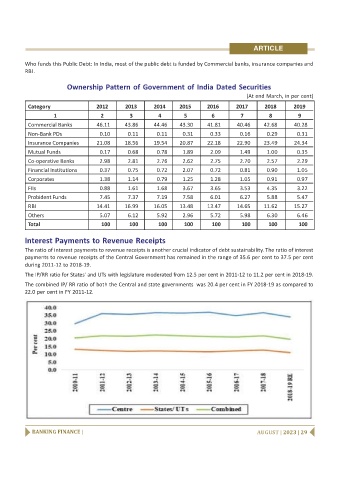

Who funds this Public Debt: In India, most of the public debt is funded by Commercial banks, insurance companies and

RBI.

Ownership Pattern of Government of India Dated Securities

(At end March, in per cent)

Category 2012 2013 2014 2015 2016 2017 2018 2019

1 2 3 4 5 6 7 8 9

Commercial Banks 46.11 43.86 44.46 43.30 41.81 40.46 42.68 40.28

Non-Bank PDs 0.10 0.11 0.11 0.31 0.33 0.16 0.29 0.31

Insurance Companies 21.08 18.56 19.54 20.87 22.18 22.90 23.49 24.34

Mutual Funds 0.17 0.68 0.78 1.89 2.09 1.49 1.00 0.35

Co-operative Banks 2.98 2.81 2.76 2.62 2.75 2.70 2.57 2.29

Financial Institutions 0.37 0.75 0.72 2.07 0.72 0.81 0.90 1.05

Corporates 1.38 1.14 0.79 1.25 1.28 1.05 0.91 0.97

FIIs 0.88 1.61 1.68 3.67 3.65 3.53 4.35 3.22

Probident Funds 7.45 7.37 7.19 7.58 6.01 6.27 5.88 5.47

RBI 14.41 16.99 16.05 13.48 13.47 14.65 11.62 15.27

Others 5.07 6.12 5.92 2.96 5.72 5.98 6.30 6.46

Total 100 100 100 100 100 100 100 100

Interest Payments to Revenue Receipts

The ratio of interest payments to revenue receipts is another crucial indicator of debt sustainability. The ratio of interest

payments to revenue receipts of the Central Government has remained in the range of 35.6 per cent to 37.5 per cent

during 2011-12 to 2018-19.

The IP/RR ratio for States' and UTs with legislature moderated from 12.5 per cent in 2011-12 to 11.2 per cent in 2018-19.

The combined IP/ RR ratio of both the Central and state governments was 20.4 per cent in FY 2018-19 as compared to

22.0 per cent in FY 2011-12.

BANKING FINANCE | AUGUST | 2023 | 29